There’s a good book waiting to be written about the 2023 Indigo saga. The plot’s got something for everyone: a cybersecurity attack for the tech junkies, a CEO see-saw and mass board exodus for the corporate drama aficionados, the ambient hum of the Canadian book industry’s existential crisis for the doomsayers, and for the nonfiction zealots—well, it’s not fiction. At this point, maybe a marketing scheme as absurd as selling a bestseller about itself is what Indigo needs to move on and, like Taylor Swift’s Reputation, reclaim its precarious rep as a selling point.

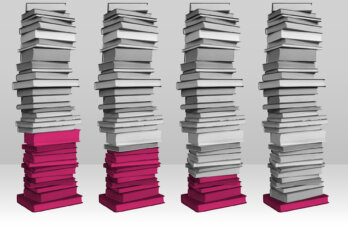

Ironically, if they did ever publish this magnum opus, it’s unclear they would even stock it. “Books Music & More” has long been the hallmark of Indigo’s approach to mass appeal, with “More” a blanket term for its interest in selling book lovers everything under the sun—including blankets. At the time of writing, on indigo.ca, there are fifty-seven items in the sex toys category, with a five-speed vibrator stamped “Staff Pick.” There’s an $800 patio umbrella in the garden section. Also: pinball machines, mug presses, portable barbeques, rowing machines, a five-foot artificial willow tree. Three hundred and two items in mug and tea sets, thirty-one in vitamins and supplements, seventeen in poufs and ottomans, 198 in bed and bath.

“More” hasn’t worked. Indigo’s profitability has been waning since before COVID-19, with a 9 percent drop in revenue in 2019. While Canadian independent bookstores have been called “one of the few economic success stories” of the pandemic, Indigo only marginally returned to profitability last year, thanks largely to online sales. This summer, Indigo founder Heather Reisman—who had pioneered its move beyond books—resigned from her role as chief executive, only to return last month when her successor resigned too. And among the four board members who resigned after the June cyberattack, one left citing alleged mistreatment and loss of confidence in the board leadership.

If we were to chart Indigo’s plot on a three-act structure diagram, the rising action is in full swing. The resolution’s still pending. But Indigo might not be past the point of no return, if the big-box bookstore revival south of the border provides any indication. As Indigo blunders, its US counterpart, Barnes & Noble, rides a revival wave: it opened sixteen stores in 2022, expects to double that number in 2023, even moving into former Amazon bookshops, and grew by 4 percent. The New York Times called it a hero.

It took a focus on books—and an international hire. James Daunt came into the role of Barnes & Noble chief executive in 2019, right after the company was bought out by a hedge fund. The company had been waning for years, closing 150 stores in the ten years prior and, in the last five, cycling through four CEOs and losing $1 billion (US) in market value. Drawing on his roots as an independent bookseller, Daunt had already revived Waterstones, a UK book chain that had been dying of ailments similar to what he found at Barnes & Noble—in his words, a “remorseless erosion of book sales.” As with Waterstones, his big-box rescue mission involved outside-the-box thinking.

First, Barnes & Noble got clean. According to the New York Times, Daunt stopped accepting what he’s dubbed “crack” (or money) from publishers to place their books in visible spots. While fast money in a slow industry, the practice would incur shipping fees when books customers weren’t actually interested in had to be sent back. Daunt then further pared down “piles of crap.” Coupled with low bookseller morale and rundown facilities, the CEO said, Barnes & Noble’s non-book products made stores ugly, wrecked business, and betrayed customers. Thus, he halted selling items that had little to do with books—like batteries, electronic chargers, water—while preserving puzzles, journals, and CDs. Needless to say, under Daunt, portable barbeques would have been out of the question.

Shops were renovated, and new stores—retail bankruptcies stemming from the pandemic gave Daunt access to cheaper space—were given complete makeovers. Shelves were rearranged by theme rather than alphabetical order. They were also laid out in warrens rather than supermarket-style aisles to encourage customers to stay a while.

Perhaps Daunt should get the most credit for relinquishing control. Refuting a top-down book-buying strategy, he handed over book-buying responsibilities to store managers. They were instructed to examine every book on every shelf, “weed out the rubbish,” then take the reins to curate store inventory, from orders to display. Rather than sales guesswork in a central office, bookselling became informed by managers with local knowledge of customers and authors and by the managers’ personal literary tastes.

“If you leave booksellers alone, they’re very good at choosing books they think can sell,” Daunt told Fast Company. While bestsellers are still stocked, Barnes & Noble stores now have more room for literary deep cuts, a shift that Daunt said makes book hunting more dynamic and less predictable for a reader on the prowl.

The pre-existing Barnes & Noble model enabled the discovery of new titles thanks to the wilderness of books its high stock volume provided. Independent bookstores, limited by constraints of space, can’t offer the same surface area for exploration, nor can Amazon replicate it with a virtual shopping cart. But now Barnes & Noble is doing better justice to discoverability by embracing its big-box-ness with enough curation to ensure that searching is rewarded. The rewards are a two-way street: in 2022, Daunt told the New York Times that book sales were 14 percent higher than before the pandemic.

Barnes & Noble isn’t exactly fooling people into thinking it’s an indie under its new leadership, but, even among some skeptics, it’s doing its job: selling books. According to NPR, one such disillusioned customer said: “It doesn’t really feel authentic. They’re trying to capture the more intimate, independent bookstore feel when it’s still just a Barnes & Noble.” Still, she left with two books.

Meanwhile, Indigo’s book curation parallels a pre-Daunt Barnes & Noble: its 2023 annual report emphasizes that “this store keeps books at our core,” but the core is largely a centralized one. Indigo store managers can offer inputs on what can be sold at their stores, but they don’t appear to have anywhere near the same control Daunt has allowed—one that effectively turns each branch into a local bookshop. Instead, Indigo’s most renowned avenue for personalization—Heather’s Picks—relies on trust in the big boss who, for a moment, quit.

Going forward, all signs point to Indigo doubling down on the miscellanea. In its 2023 annual report, Canada’s biggest bookstore declared a new brand platform called “Life, on Purpose” and a plan so broad, yet so densely worded, that it’s best quoted in its entirety: “Indigo retail stores reflect a transformation from a bookstore to a next-generation cultural concept store; a physical and digital meeting place inspired by and filled with books, music, art, ideas, and beautifully designed lifestyle products, all aimed at simplifying its customers’ journey to Living with Intention.”

The plan’s in action already, with the first large-format “Store of the Future” that meets the “Living with Intention” vision having opened in Ottawa last December, staged with beds for sale and “introducing both centralized and dispersed seating.” Another one opened in Toronto in October. It will sell beer, vinyl, and, among other stuff, coffee from a truck. Ex-CEO Ruis imagined it as “a total lifestyle emporium.” It seems obviously strange for any big-chain store to present itself as a facilitator of a meaningful life, as they are, inherently, hugely impersonal. Still, it’s yet to be seen if the new “Living with Intention” approach is any better than its prior “beyond books” approach. While e-commerce grew significantly compared to pre-pandemic levels, and boxing week sales in December broke records, it’s still unclear how much of Indigo’s 2023 losses—$49.6 million, to date—are due to the cyberattack.

But Barnes & Noble’s example suggests that skirting the mainstay of its identity—books—isn’t necessarily a sustainable model for a business that exists in the public imagination as a bookstore. No matter how much general merchandise might have edged it toward the lifestyle genre, a big-box bookstore like Barnes & Noble has always been a beast separate from a department store. Daunt put it this way: “Nobody thinks, ‘I need a Duracell battery—I’m going to go down to my bookshop.’”

In an era of book bans, the death of big independent analogues like Toronto’s World’s Biggest Bookstore, and the shuttering of independent bookstores, Indigo is needed. While figures on Indigo’s market share aren’t publicly available, a 2022 survey found that independent bookstores account for only about 13 percent of Canadian book-buyer purchases. Indigo remains Canada’s leading bookseller, and, without it, Canadian publishers would lose a massive buyer, as made stark by the scale of Indigo’s losses in the wake of the cybersecurity incident. What few need—as the decline of non-discount department stores reflects—is a bookstore that sells, among many other things, five-foot artificial willow trees.

In a recent interview on BNN Bloomberg a few weeks into her return as CEO, Reisman acknowledged that Indigo “took a journey off-course” by expanding its lifestyle repertoire over the past few years, particularly under Ruis. These products didn’t meet the requirement of a strict focus on general items that “inspire reading and enrich the lives of our customers,” she said. As she hunts for a successor who can better feel the Indigo brand “in their soul,” she promised a focus on books. She offered few specifics but hinted at some last-minute tweaks to the new Toronto store that recently opened. “The core of this business is going to come back,” she said. “Books will move to the center.”

In the meantime, publishers are on hold, waiting for Indigo’s next move. Noelle Allen, publisher of Wolsak & Wynne, said that, since the cyberattack, sales to Indigo have dropped. “As Indigo sort of tries to figure out their mix, it’s going to be much more work with the independent bookstores to hopefully carry more copies of our books,” she said. “We do have to probably increase our online presence and continue to reach out directly to customers.”

Norm Nehmetallah, the publisher of Invisible Publishing, said that Indigo’s shakiness makes him more worried for the whole Canadian book industry than his own Toronto-based press, which stocks titles with Indigo. “I think it’s a problem that Indigo exists in its current incarnation,” said Nehmetallah. If any new turmoil has them shut down stores, “then whole communities in Canada are left without a functioning bookstore.”

Correction, November 8, 2023: An earlier version of this article stated that Indigo had opened a new store in Ottawa in March 2023 and planned to open another in Toronto next year. In fact, Indigo Rideau (in Ottawa) and Indigo at the Well (in Toronto) opened in December 2022 and October 2023 respectively. The Walrus regrets the errors.