It took over three centuries and a Canadian to make it happen, but when Mark Carney was hired as governor of the Bank of England, in 2013, he became the first foreigner to run the institution since it was founded, in 1694. The response to his appointment was rapturous, bordering on parody. The British press alternately called him a banker from “central casting” and a “rock star.” Carney, stepping away from the same position at the Bank of Canada, was just forty-eight years old. He was brought on to modernize the UK’s ossified banking system, and kudos poured in from the left, the right, and the centre. “Mark Carney is the outstanding central banker of his generation,” former chancellor of the exchequer George Osborne told the House of Commons.

Then, Brexit.

From the moment then prime minister David Cameron floated a referendum to leave the European Union, in the early months of 2013, until the day the exit was made law, Carney was increasingly in the spotlight. He was asked, repeatedly, what impact leaving the EU might have on the economy. Tradition dictated that the bank governor remain above the political fray. Carney, however, was blunt in his assessment that the decision could lead to economic disaster—he even worried publicly about the possibility of a “cliff-edge Brexit.” He did not venture this as offhand opinion: he was, after all, governor of the central bank. Nevertheless, this was seen as taking sides. Suddenly, in certain parts of the country and some segments of its media landscape, he went from being Hugh Grant to Hannibal Lecter.

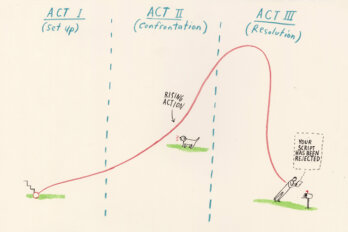

The fact that Carney’s original assessment would be proven right wasn’t politically relevant. Nor did it stem the criticism, even after he was asked by the Conservative government, not once but twice, to extend his original five-year contract so as to maintain stability and continuity in the Brexit rollout. The drama—which ended for Carney last year, his tenure finally complete—may have been theatrical, but it also highlighted the many ways that electoral politics can be a dirty, unpredictable business in which intellectual analysis and raw emotion do not always share the same cab. For Carney, it’s an experience that may yet come in handy.

Listen to an audio version of this story

For more audio from The Walrus, subscribe to AMI-audio podcasts on iTunes.

In the months since Carney arrived back in Ottawa, where he now lives with his wife, British economist Diana Fox, and their four daughters, he’s landed a few plum positions: he’s taken a seat on the board of digital-payment unicorn Stripe, and he’s now heading up asset-management firm Brookfield’s expansion into social and environmental investing. He has also continued his role as United Nations special envoy on climate action and finance. Still, there have been whispers about what, exactly, he plans to do next. With the release of his first book this spring, Value(s): Building a Better World for All, they only got louder.

In early April, Carney was a keynote speaker at the Liberal party’s federal convention. During his speech, he committed himself to the cause, stating, “I’ll do whatever I can to support the Liberal party in our efforts to build a better future for Canadians.” It’s a line that has drawn many close readings in the media. The Canadian Press reported that his appearance was a “political coming out party of sorts” that marked “the first public dipping of his toe into partisan waters.” Pundits, and their unnamed inside sources, speculated that Carney could be on the next ballot, with some venturing that he could soon be minister of finance. Others have even gone further, naming him a potential successor to Justin Trudeau as Liberal leader and, if voters say so, prime minister. Still, Carney isn’t committing either way. At a recent virtual event held by the University of Toronto’s Rotman School of Management, he was asked whether politics was in his future. Carney played it coy: “I never say never.” He is certainly primed for a leap into a leadership position, but is that a job he actually wants?

On February 1, 2008, Carney, then forty-two, got a promotion: he was to become governor of the Bank of Canada. Even with his impressive CV, it represented a rapid ascent for the relatively young man who grew up in Edmonton: undergrad at Harvard, doctorate at Oxford, and success as an investment banker with Goldman Sachs in London, Tokyo, New York, and Toronto. He switched from Goldman to the public sector in 2003, landing roles at the Bank of Canada and the Department of Finance before being named governor—the youngest central banker in all of the G20.

Almost immediately, a calamity hit. Carney was still familiar with the world of Wall and Bay Streets, and he perhaps sensed, ahead of other central bankers, that the financial realm, faltering since 2007, was in jeopardy. Just a month into his tenure, while EU member states were raising interest rates to reflect a healthy economy, he cut Canada’s overnight rate by fifty basis points—a kind of fiscal booster shot that anticipated and, for Canada at least, moderated the trouble to come: the disastrously overleveraged state of credit default swaps and obligations that would ultimately overwhelm global markets and bring about the Great Recession.

There’s a chasm between the day-to-day job of being a bank governor and what the public might imagine they actually do—at least to the extent that anyone thinks about bank governors at all. Craig Wright, chief economist at RBC for over two decades, explains that the main job is to hit the inflation target the bank and the government deem advisable, which, in Canada since the early nineties, has been somewhere between 2 and 3 percent. On average, says Wright, Carney always found that 2 percent sweet spot. “That’s what you aim for in normal times,” Wright says. “Mark has been through a couple of abnormal times.”

In some ways, a bank governor is a bit like the captain of a giant steamship crossing the Atlantic—let’s call it the SS Stability. Know your charts, set a judicious course, keep a close eye on things, and it should be smooth sailing. Unless, of course, there’s a hurricane (credit crunch) or rogue wave (recession), at which point all hell breaks loose, your crew starts to panic, and every decision, big or small, is monumental. If you choose wrong, you’re going down.

Angelo Melino has been on faculty at the University of Toronto’s department of economics since 1981 and briefly worked for Carney as a special adviser to the Bank of Canada in 2008/09. “He was a very good crisis leader. I mean, he’s not a large man, but you would not know that if you were in a room with him,” Melino says. “He was very good at inspiring people to work hard. Everyone saw that this was a crisis, and he showed that he was a good leader and a very good decision maker.”

This became even clearer a few years later, when Carney was poached by the Bank of England. It was an institution that, by most accounts, needed to have the boardroom doors thrown open to the sunlight. Carney was hired to do the door-flinging. He was to oversee changes in communications policy at the famously tight-lipped bank as well as bring about reforms in technology, diversity, digital currency, briefing frequency, and even the printing of plastic versus paper money. It was a bigger role that came with more attention. A lot more attention. Intelligence, charm, and diligence could parry some, but not all, of the daggers. “I think it’s safe to say that the level of scrutiny in public roles in the UK is intense and unrelenting,” he says with a laugh during our call.

But, though he initiated an era of modernity at the bank, there remains debate in the financial community as to his overall effectiveness. Phillip Inman is the economics editor of the Observer. “If you talk about a crisis, then Mark Carney is your man,” he says. “He didn’t have to deal with the worst of the Euro crisis that happened just before he arrived, but it was still being felt when he arrived in 2013. Then, of course, we had the Brexit vote, in 2016, and he was a model of calm while everyone else was losing their heads.”

The story of Carney’s time in the UK is, in many ways, wrapped up with the story of Brexit. According to the Times, before taking up his post as governor, he sought assurance that there were no plans to hold a referendum on leaving the European Union (something that the Bank of England later denied). It did not take clairvoyance to predict the chaos and fractiousness such a process would bring about, regardless of the outcome.

According to Inman, it is important to remember the milieu in which Carney was operating: the financial sector considered Brexit earth shattering. “Not just an economic disaster,” he says. “A cultural disaster. A step backward in almost every way you can think of. And Carney had to stay calm and act quickly.” This was particularly crucial, says Inman, due to the Bank of England’s slow response to the 2008 recession—something that led to a lagged recovery and an awful lot of criticism.

Though Carney impressed early on, Inman says, his response to the latter stages of Brexit proved subpar. Like most other central bankers, he says, Carney’s technical tool kit was quickly found wanting. This, Inman argues, was where Carney’s naïveté about Britain was exposed. “Events never panned out as he predicted: wage growth never got high enough. He was a poor forecaster,” Inman says. “He had interest rates at rock bottom, he was doing all he could to facilitate growth and wages growth, but the mistake he made was that it takes more than that to jump-start recovery.” He adds that Carney’s policy of “forward guidance”—offering long-range direction on interest rate movement to promote economic stability—also proved contentious. Carney would announce that rates would soon go up to reflect increases to inflation and a healthier economy. But time would pass and nothing would change. “Month after month, year after year,” says Inman, “we would get Carney’s forecast of inflation rising and interest rates coming in to calm it down. And [the increases] never happened. Even when you start to get a sustained recovery, which didn’t happen until 2017, this is four years after he’s joined the bank. We had four years of ‘It’s coming.’” Carney was, in Inman’s opinion, misreading the situation before him.

Of course, some have always claimed there’s a whiff of smoke and mirrors to the work of economists. I remember, from earlier reporting days, Ralph Klein’s chief of staff, Rod Love, joking about economists: their ways, their mysteries, their arcane lexicon. It came with the punchline, Don’t get me wrong, I love economists. They’ve predicted seven of the last two recessions.

UK Labour MP Pat McFadden may have been feeling similarly inspired in 2014, when he likened the Bank of England under Carney to an “unreliable boyfriend” for the mixed signals it was sending over the timing of future rate hikes: “One day hot, one day cold.” It was a characterization that stuck even after Carney ditched forward guidance as a policy. “He was quite thin-skinned about it,” says Inman. “I would attend press conferences and ask him direct questions, and he was very prickly when you asked questions that appeared to impugn his forecasting or his social conscience or any of the things that he felt he should be praised for. As in, ‘Who are you to question my authority?’ Very sharp and dismissive. When everything’s going well, he seems very confident and it’s all lovely. But, when things are not going so well, in a one-to-one personal situation, he’s quite prickly. And his reputation inside the bank was quite authoritarian.” Carney was reported to have earned some infamy among bank staff. According to BNN Bloomberg, “Being on the receiving end of sudden flashes of fury became known as ‘getting tasered.’”

With the honeymoon period over, Carney’s manner and performance were regularly questioned by the media, with the caveat that a public figure receiving a mauling by the British press is like winter in Edmonton: the question is not if or when but how bad and for how long. Philip Aldrick, economics editor and columnist for the Times, was one such critic. After Carney’s tenure ended, Aldrick wrote that “the quantitative easing he oversaw at the Bank widened inequality and provided [chancellor of the exchequer] George Osborne with a cover for austerity.”

The bottom line, says Inman, is that Carney’s legacy at the Bank of England is simply more conventional and conservative than Carney and his advocates may believe it to be. “I just think he was more of the same,” says Inman, “rather than somebody who was a bit of a new broom.”

Carney insists that he enjoyed his experience in the UK but admits it was a fishbowl existence he was unaccustomed to. Everything from his marathon times to his expense claims received public airing. “In Canada, I was recognized, but I basically had a normal life,” he tells me. “In the UK, I did not. It was exceptionally difficult to do anything that was not in the public eye, so there was a level of scrutiny that was remarkable. As it turned out, with the Brexit cliffhanger, I ended up doing seven years, so I was there longer than I originally intended. If there’s an unasked question, by that point I’d been a G7 central bank governor for thirteen years, and you only get one life. I enjoyed it. It was a privilege. It was very intense. But it was enough.”

Thirteen years, two banks, two crises. How do you follow that kind of record? So far, one of Carney’s primary areas of focus has been his new book, Value(s): Building a Better World for All. At nearly 600 pages, it is learned, passionate, well researched, reasonably well written, and surprisingly accessible for a text encompassing politics, economics, history, and philosophy. All orbit around the ideas of value and values: how we find them in the market and how we promote them among ourselves. Yet it also presents something of a mystery: Whom, exactly, is this book for? It feels too colloquial to serve as an academic text, too academic to appeal to a general readership. Suffice it to say, at the literary or emotional level, the book is no Obama memoir. “I’m not hanging by the phone for the call from Oprah,” he jokes. In a way, the book seems to represent the duality of Carney’s public persona: part policy wonk happiest at Davos, part hometown hero keen to introduce himself and his ideology to the wider world.

Prosperity, Carney argues, is most likely going to be greatest when we can balance economic growth with social values.

It’s difficult to reduce Value(s) to a bite-size summary, but one thing it expresses consistently and in various ways is that Carney is not a free-market fundamentalist. In this, he falls into the traditional liberal camp: markets are run by humans and humans have emotions, biases, failings. The book is undergirded by an almost plaintive appeal to the decency in each of us as individuals and all of us as a collective. Prosperity, he argues, is likely going to be greatest for most when we can balance economic growth with a broader set of social values. That means limits; that means regulations. “When left alone, ultimately the market will consume the social capital that is needed to support the market,” he tells me. “You’ve got to be careful to balance things so you don’t lose the dynamism and innovation that only the market can provide. But some things aren’t trade-offs, right? We’re in a COVID crisis. With the people in the old-age home across the street, it’s not their lives versus the economy.”

It’s not just that the free market is too volatile when unregulated, Carney argues in his writing, but that it is also prone to systemic and episodic failures, which, combined with human frailty, means we must keep both a collar and a leash on this powerful beast. His call for a regulated and equitable financial system doesn’t appear to be a self-conscious bit of politicking: after all, if he didn’t hold these beliefs, Carney could have remained in the private sector, earned his millions, and we’d have never heard his name in the first place. Which raises the question that, if this is all part of the bigger picture he’s painting, what’s the next brush stroke? “In retrospect, everything might look quite logical and well planned out,” Carney says of his career. “But I’ve just gone to things where I felt it was a challenge and it interested me.” One potential challenge that has been simmering for some time, however, may be coming to boil.

John Ibbitson has been a political writer and columnist for the Globe and Mail since 1999. Mark Carney has been on his radar, to one degree or another, since he first appeared as a young governor at the Bank of Canada. Even then, Carney was rumoured to have political aspirations.

“He’s a fascinating character,” says Ibbitson. “If he were to run as a Liberal, he could bring increased credibility on economic issues in an area where that party is deemed by some to be weak.” Ibbitson did reiterate that the job of prime minister is currently filled and will be for the foreseeable future. But Trudeau won’t be leader forever.

Even if that tumbler did unlock, there are questions about whether Carney should open the door. The Liberals, notes Ibbitson, have been known to choose leaders who look great on paper and then struggle on the ground, Michael Ignatieff and John Turner being perhaps the two best examples of intellectual heft that turned into political dead weight, mostly due to an absence of the common touch. Voters, after all, don’t necessarily want the smartest person for the top job—they want someone they trust. And getting to that position is always a fight. “Does Carney take relentless, vindictive personal attacks, both from opposition politicians and from a portion of the press?” Ibbitson wonders. And, even if he can take it, can he dish it out? “On paper, he looks great as a candidate. He is formidably qualified for a senior role in public life,” Ibbitson says. “But politics is a blood sport.”

Naturally, there are skeptics about whether Carney will commit to running. “I would have thought him being rather thin-skinned would be his Achilles heel in politics,” says Inman at the Observer. “In terms of understanding the tectonic plates of international capitalism, how everything fits together and how it works, and knowing all the top people across the world, he does. I could see that being a great appeal, but the campaign trail can be brutal. Another thing that will stand in his way as a politician is that he talks in a way that is technocratic, which is loved by people when referring to their central banker but not much good in a politician.”

Philip Aldrick, in a recent Times book review, referred to the rumours surrounding Carney’s aspirations. “If Value(s) is a political manifesto, it is that of Davos man. The benevolent belief that, with a few tweaks, the ‘citizens of nowhere’ can reorganise capitalism for the collective good to save the world. You believe Carney has the sheer will to make it happen, but not the self-awareness . . . . If he wants to be PM, he will need to speak human first.”

Still, signs have been accumulating. One potential clue can be found in his book’s acknowledgements section: “Gerry Butts kindly reviewed the draft manuscript and provided essential insights.” Yes, that Gerry Butts—longtime chief adviser and former principal secretary to Justin Trudeau. I ask Carney if anyone ought to read anything significant into that detail. There is a pause, then a laugh. “No,” he says, “except that he’s a smart person, and if you want somebody to read your manuscript, you get someone like that to take a look.”

We probably won’t have to wait too long to find out Carney’s intentions given the Liberals’ minority rule—an election can’t be too far off. But, for now, the only thing known for certain is that he has been engaging in his own version of forward guidance, signalling to both party and public that he is worth long-term investment.

In one chapter of Value(s), “How Canada Can Build Value for All,” Carney pays homage to his homeland in all the conventional ways: Canada gave him his chance in life, educated him, taught him his values; it is a magnet for talent, has a wonderful cultural mosaic, turns challenges into opportunities; there is nothing we can’t accomplish if we work together. “I believe Canada is not just the present but very much the future if democracies are going to thrive,” he writes. “That’s why I want to help us reach our full potential and shape the future, right here at home.” He then lays out a ten-point plan that governments can follow to achieve value-based prosperity, which ranges from the boilerplate (building a new economy in which all can thrive) to the expected (greening the economy) to the genuinely interesting (developing intergenerational accounting practices to track sustainability). In the end, he says, Canadians need to support one another from “coast to coast to coast.” Although Value(s) does not, in sum, read like an electioneering document, there are sections that cannot be read as anything other than political semaphore.

In his book’s final chapter, “Humility,” he returns to an earlier anecdote about Pope Francis, who once suggested to an intimate gathering of influential people, of which Carney was part, that just as grappa is wine distilled—nothing but pure alcohol—the market is “self-interest, humanity distilled.” The job of those assembled before him, the pope solemnly said, was to turn grappa back into wine.

The pope may have been onto something. The trouble is, the only way to know what you’ve got is to uncork the bottle, let it breathe, and give it a try. Only then can you really see what’s inside.

July 6, 2021: An earlier version of this story stated that Canada has had an inflation target since the late eighties. In fact, the target was introduced in the early nineties. The Walrus regrets the error.

July 12, 2021: An earlier version of this story stated that Canada’s inflation target has fallen between 1 and 3 percent. In fact, it has been between 2 and 3 percent. The Walrus regrets the error.