The Virgin Australia flight bound for Papua New Guinea departs from Brisbane bearing a full load: gigantic sun-cured men in golf shirts; neckless security hacks scribbled over by tattoo artists; inscrutable, terrifying power suits. Over a muggy sweep of brine, the plane arcs toward a nation that occupies the eastern half of the island of New Guinea and a farrago of smaller islands scattered across Melanesia. Australians, its colonial overlords between 1905 and 1975, don’t pay PNG much mind any longer—the country is little more than a volcanic absence lurking 150 kilometres north of mainland Oz, a shadow in the dead of the South Pacific.

But PNG is a global player—just ask an accountant for any major transnational mining corporation. Take the mist-shrouded valley of Porgera. Located 600 kilometres northwest of the capital, Port Moresby, it stands at the very end of the road, with the muddy mountain hamlet of Mongolop acting as a final milestone. Comprising corrugated iron shacks, graffiti-tagged outbuildings, and a clearing where kids play rugby, the community sits atop a hill whose highest point opens onto a Catholic mission’s jungle garden, immaculately maintained by the resident Filipino priest. A blank-eyed wooden statue of Christ stares out at the reigning deity around these parts: the yawning pit of a mega-mine, a slice of Canadian real estate in the middle of the middle of nowhere.

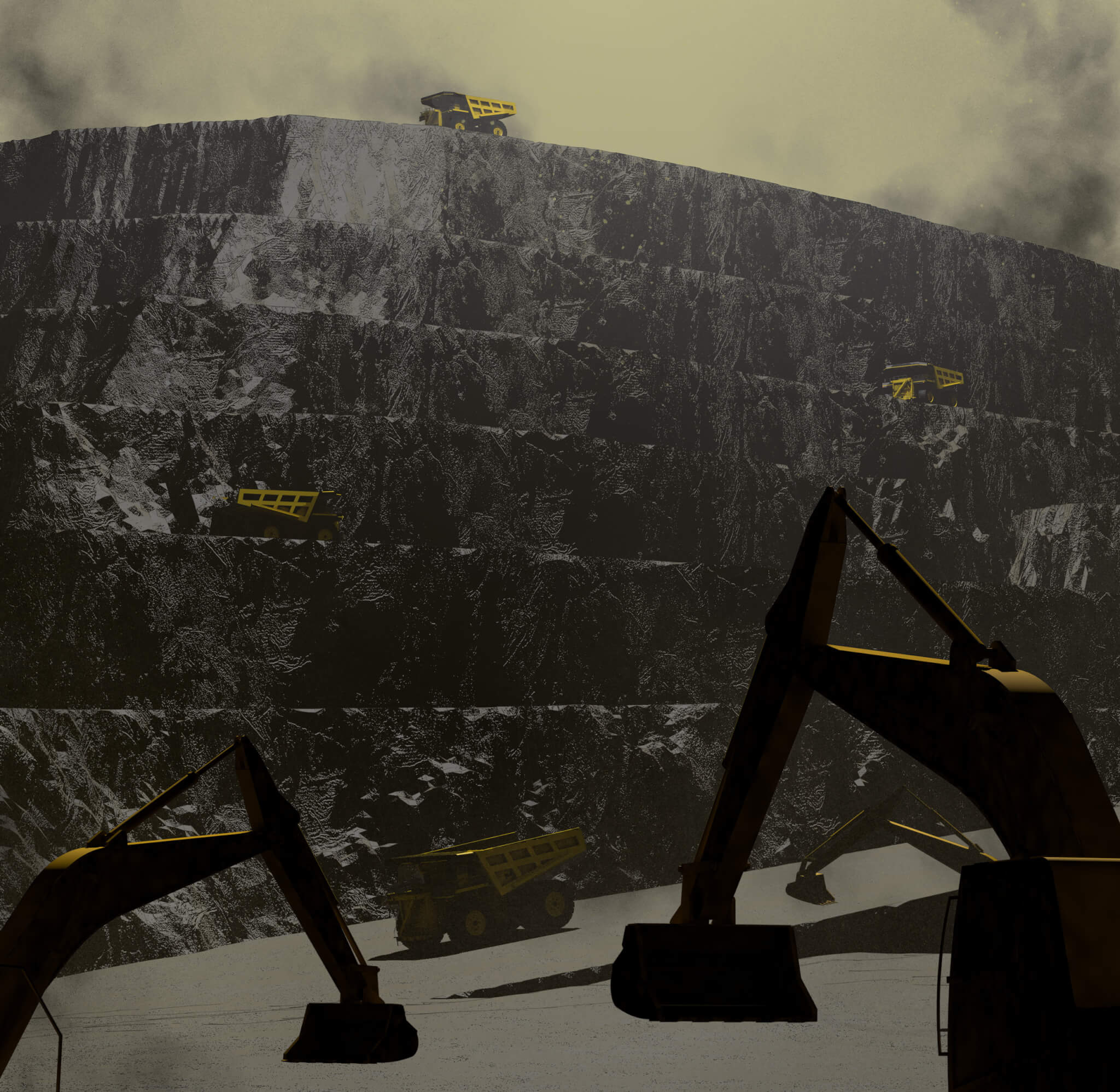

The pit itself resembles a signature geological event, a seismic suicide attempt. It tumbles down the face of Mount Peruk in a series of terraces, as if scooped out by an army of orcs. In the late 1980s, a Vancouver-based mining house called Placer Dome made a deal with the national government, the northern province of Enga, and a cabal of local landowners—the representatives of at least eleven official Porgeran clans—who continued to live inside the boundaries of the site. The so-called Porgera Joint Venture (PJV) was inaugurated in 1990, and when Barrick Gold acquired Placer in a blockbuster deal in 2006, it had already metastasized into one of the most productive gold mines on the planet.

Barrick was founded in 1983 by Peter Munk, a Holocaust survivor, technology executive, and successful hotelier who had returned to Toronto from the South Pacific in 1979 to seek commodities glory. Barrick was not a mining company but a company that bought mining companies. In 1984, it purchased a stake in Renabie, based in central Ontario; shortly after, it bought Camflo Mining, which operated at the time in Quebec and Nevada. Nevada’s Goldstrike mine entered the fold in 1987, and with gold on an extended bull run, it wasn’t long before Barrick barged into Canada’s corporate pantheon.

Barrick has a lengthy rap sheet, one that includes allegations of worker mistreatment and waterway pollution. For environmentalists and anti-mining activists, the company has long been the ne plus ultra of capitalist wrongdoing. While it conducts 75 percent of its business in North America, Barrick’s sites are located across at least four different continents and employ more than 14,000 people in countries as far-flung as Argentina, Chile, the Dominican Republic, Peru, Saudi Arabia, and Zambia, often in the face of violent opposition from locals. The recent commodities price crash has been cruel to the company, which made some ill-advised expansion forays, especially into copper mining. An asset dump and corporate shake-up ensued. While the majority of PJV itself is no longer owned by Barrick, which sold 50 percent of the mine’s Niugini holding company to China’s Zijin Mining Group last year, it still manages the operations.

At least $20 billion worth of bullion has been pulled from PJV in the mine’s lifetime; between 1990 and 2009, Barrick estimates that the mine accounted for an astonishing 12 percent of PNG’s total exports. While this has thrilled the country’s political establishment, not every local landowner considers it a square deal. That’s why, for much of the mine’s existence, the pit has been overrun by thousands of what Barrick and the PNG government consider “illegal miners.” Every level of the vertiginous pit has been occupied by locals, sometimes working at the equivalent of thirty storeys without safety equipment. Even today, a few torches can be seen at dusk, trapped in the darkness of the pit wall, hundreds of metres above the haulage trucks beeping below.

Even in the best of circumstances, PNG is not renowned for law and order. But this was a gold rush, and in the absence of state enforcement, Placer/Barrick tried to curtail incursions with a combined corps of police and hired guards. The illegal miners would not be so easily curtailed. And so the locals and PJV’s security apparatus went to war.

Caught up in this violence was a woman named Marawanda Wakapu. In the 1960s, when Wakapu was still a girl living in Mongolop, Australians and New Guineans panned the Strickland River for gold. Their activities were part of the transition from rough-and-tumble small-claims digging to the grim professionalism of mega-mining. Following more than 40,000 years of near isolation from the outside world, New Guineans were, nearly a century ago, introduced to global commerce by way of the digger’s pickaxe. Locals suddenly had access to a cash economy, which ushered in alcohol, electronics, roads, and modernity—an insta-future exploded across the region. There was copper to be mined, as well as zinc, oil, and gas. But mostly there was gold. Three of the world’s richest gold mines are now located in the region: Lihir, on Lihir Island; Grasberg, next door in West Papua; and, of course, the PJV.

Wakapu grew up and grew old with the mine. Today, she appears as if whittled from a hardwood sprig, and speaks Porgeran at a runaway clip. When younger, she would forage for food in the bush or pan the waters of the Strickland for bits of gold. Then came the Canadians, and with them the pit, the benefits of which stubbornly refused to trickle down. After lengthy and contested negotiations with the Porgera Landowners Association (PLOA), local royalties were pegged at 2 percent of net sales, which works out to more than $10 million a year. Half of that goes to the provincial authorities, and half goes directly to the landowners through the PLOA, which is meant to be in charge of community projects such as the construction and maintenance of health and education facilities.

But the PLOA operates without transparent accounting processes, and it has never been audited. As far as Wakapu was concerned, nothing tangible—which is to say, money—was forthcoming. She found herself living in squalor in the midst of an active gold-mining operation. Unable to subsistence farm—an activity on which most islanders depend for their livelihood—she went out onto the mine dump searching for waste gold. In March 2003, while panning in the Strickland, Wakapu was approached by a security officer who wore a uniform that identified him as a Placer Dome employee. According to testimony that Wakapu would later give to human-rights organizations, the guard guided her into the bushes, grabbed her by the throat, and ripped off her clothes. Then he raped her. A year after that first assault, she was raped again, this time in a prison cell by a drunk guard.

“The pain now,” she told me through a translator as we sat sipping Cokes in a cramped conference room, “is that I know that I’m a landowner. Why am I going through this?”

In 2005, rumours of countless rapes, many of which bore similarities to the events described in Wakapu’s testimony, started to emerge from the valley. At first Barrick treated them as “furphies,” Australian slang for canards. “[T]o our knowledge,” the company responded in 2011, “there have been no cases of sexual assault reported to mine management involving PJV security personnel while on duty, since Barrick acquired its interest in the mine in 2006.”

Yet reports disputing Barrick’s conclusions were being collected by NGOs in the valley, most notably Ottawa-based MiningWatch, which was in this case represented by an experienced anti-mining activist named Catherine Coumans. Human Rights Watch mounted its own investigation and eventually released a report in 2011 entitled “Gold’s Costly Dividend: Human Rights Impacts of Papua New Guinea’s Porgera Gold Mine.” The rape allegations—which ballooned from eight to a number well into the hundreds—were never tested to Canadian legal standards of admissibility: there were no rape kits, and in some cases, no eyewitness reports. But in a context such as this one, where exclusion from PNG’s conservative society can be worse than assault itself, lawyers working on the victims’ behalf determined that false reporting was unlikely. “We conducted interviews with women from different clans who didn’t know each other but shared similarities—and bizarre, sadistic details,” a human-rights lawyer told me. By 2014, when all the evidence had been compiled and all the testimony collated, it appeared that acts of sexual violence had been perpetrated on an industrial scale.

How was it possible for a Canadian company to have been implicated in such heinous activities without triggering more official scrutiny? The behaviour of private and public law-enforcement personnel in the Porgera Valley between 2000 and 2010 says much about what has gone sideways in the global Canadian extractive industry over the past half-century. Mining is “the family business,” former foreign minister John Manley has said, one that, according to the Mining Association of Canada, contributed $57 billion (or 3.1 percent of GDP) to the Canadian economy in 2014. But it’s also a business that often involves Canadian companies in conflicts with communities abroad,in countries with few human-rights laws or meaningful legal protections.

The scale of the violence in the Porgera Valley, however, appears to have at last pushed Canada’s transnational diggers to adopt a new, more progressive mindset. Last June, for the first time in its history, Barrick was presented with the 2016 General Counsel Award for Corporate Social Responsibility, given annually to a company whose policies exemplify ethical business practices. But have Barrick’s tribulations in PNG really crafted a better future for the extractive industry and the people directly exposed to it? Or are we living in a time of more sophisticated human-rights washing—an age of better, slicker spin?

Tim Andambo, manager of PJV’s community-affairs department, is a short, powerfully built slab of a man. A scar on his forehead is a remnant of a forgotten tribal war, and he keeps his scalp shaved close—like a post–cage match UFC fighter. Andambo is a local “big man”—or leader—from a tribe called the Ipili, and he rose through the ranks to serve as perhaps the most important element of PJV’s socially responsible new era.

Out there in the community, Andambo is the face of the mine. As I drove around with him, hunched men in tattered winter coats approached his Toyota Land Cruiser and asked him for favours, for work, for handouts. Time and again, they opened the door insistently, and just as insistently, Andambo pulled it closed. “They don’t understand—I can’t just give everyone work,” he said. This new form of community relations was startlingly intimate and no longer ran parallel with, or ancillary to, security operations—it was security operations. In April, a huge chunk of mountain slid into the access road, wiping away an informal settlement. Barrick and the community, using the mining company’s equipment and expertise, cleared it up together—an example of communalism that would have been unheard of even a few years ago. The glad-handing extended to Barrick’s open-door policy regarding visiting journalists, including this one: complimentary flights up to the site, a bunk, a meal or three, and access to every last person in the valley, enemy or friend.

For all its newfound bonhomie, PJV is by no means a laid-back environment. Bags are searched after landing at the nearby Kairik Airstrip. In a perverse variation on the South Pacific conch-shell greeting, blowing into a breathalyzer constitutes a welcoming ritual. For employees, booze and drugs are verboten; downloading or streaming pornography results in immediate termination. Life here is simple: breakfast, work, dinner, sleep.

A good indication of the extent to which a mining operation is accepted in the community is whether vehicles can travel safely through it. Andambo drove a Barrick SUV with grills protecting the windows, the cabin rendered claustrophobic, at a speed below forty kilometres per hour. A year ago, Andambo told me, locals would throw rocks at mining vehicles. “The violence toward us has quieted down,” he said.

Nevertheless, as we wound through the dirt roads that crossed the single paved main drag, he became distressed. “Nobody’s in charge,” he said, pointing to the poorly maintained rugby field, then to the shuttered Porgera Market, a wretched impromptu bazaar stretching the length of the city. Cloud-covered peaks rose up to our right, while on our left, betel-nut sellers lined the streets, peddling the mild narcotic that is the national poison. Sewage ran down the sluices, and when we opened a window, the thin mountain air reeked of human waste. Many of the community initiatives we visited had received start-up cash and maintenance funds from the mine. “And yet the people complain that the company doesn’t do enough,” said Andambo.

Part of the job of the community-affairs manager is to highlight the social-responsibility initiatives that Barrick has put in place and link them with the needs of the community. The problem is that the community needs everything. Andambo’s gripe struck at the heart of the transnational mining paradox: Barrick, for all its wealth and community immersion, isn’t duty-bound to govern Porgera. PNG’s government is. Where is the evidence of its involvement? When I asked, Andambo just laughed bitterly.

“The royalty money should go a long way, but it doesn’t,” Ila Temu, Barrick’s executive country director, told me. This is just one of the reasons why, as is the case with almost all of the major mines in developing nations, there is little in the vicinity of the site that an economist would term “diversification”—no factories down the value chain that would suggest economic rather than social or environmental transformation. There are provincial corporations such as Mineral Resources Enga; community-owned haulage and catering collectives that serve the mine; and the PLOA, which is meant to disburse royalties to legitimate landowners. These initiatives have, for the most part, served only to expose the discord in the valley. Local or otherwise, corruption defines governance in PNG.

The upshot of all this? PJV is, according to operations director Gregory Walker, “the de facto government in the area.” If the mine were simply to disappear, Porgera would slide immediately into the Dark Ages. Nothing that has occurred here in the past twenty-six years could be considered sustainable; even the millions of tonnes of tailings dumped into the Strickland would eventually be washed away with time.

As a result, PNG remains mired in resource-related dysfunction. The recent commodities super-cycle, an extended period of high prices for raw materials, driven largely by growth in China, bumped up the country’s GDP over 8 percent a year from around 2010, making it one of the fastest-growing economies in the world until 2014. And yet, in 2015, the United Nations Human Development Index ranked PNG 158 out of the 188 countries on the list. (Australia is ranked second, Canada ninth.) Two-thirds of citizens live below the poverty line, while only 40 percent of the population has access to clean water, and 45 percent to sanitation. In rural areas, just 2 percent of households use anything Canadians would recognize as a toilet.

It was a typical Monday morning, and Andambo and his colleagues had learned that, in nearby Yaparepe village, one person had been killed and another badly injured in tribal violence during the night. At dawn, sixty illegal miners tried to make it into the pit but were chased off by local villagers—a raid that anywhere else would have been considered a full-blown assault, but that in PJV was brushed off as business as usual.

Andambo steered his Land Cruiser into town, and we found that the bank had closed because the generator was out of fuel, which meant the hospital couldn’t withdraw the 350,000 kina—or roughly $144,000—it had received to buy diesel, leaving the region and its estimated 50,000 inhabitants without a functioning health-care facility. In faraway Port Moresby, news reports warned there was a chance that Prime Minister Peter O’Neill was about to be arrested along with his police commissioner—if that happened, cops would be called to the capital in order to prevent, or perhaps to perpetrate, chaos.

About those cops: In the early 2000s, when Placer/Barrick’s guards were in almost constant conflict with the community, the small local force of police officers was effectively useless. Barrick assembled a contingent of nearly 450 private security personnel to staff its Asset Protection Department. “We employ our own security, but we also have government police on the ground helping us operate within the valley. So they look after the law-and-order situation,” Temu told me.

But that was only partially true. When it came to the issue of who would be financially responsible for the top-up in policing, along with a recent call-out for the army, Barrick opted to bankroll the bulk of the costs, which included paying for training and the building of a new barracks, all of which would be deducted from its tax bill—a compensation mechanism that shifted the burden of police oversight from Port Moresby to PJV. Did this mean that the cops were in the area to keep the general peace, or were they Barrick’s boys, there to protect the mine, with no intention of serving the locals?

Regardless of the answer, Placer/Barrick has thrown in its lot with a policing culture that, in 2013, featured cops with bush knives slashing the ankles of seventy-four men in retribution for a street brawl. “Papua New Guineans face violence at every turn, including from the police, who should be protecting them,” wrote Brad Adams, Asia director at Human Rights Watch, in a statement.

Because of the massive influx of law enforcement, and thanks to new community-outreach policies, violence in the valley was somewhat quelled. But as far as Andambo was concerned, violent or not, a community without governance would keep sliding into the abyss. “I see this place going backwards,” he said, yanking the Land Cruiser’s steering wheel toward the main drag. “There’s no leadership here.”

The headquarters of Porgera Joint Venture is a series of two-storey blocks fashioned from concrete, glass, and aluminum, and has a distinct NGO-schoolhouse-in-Uganda sensibility to it. Scattered around the offices are laminated maps that depict the mining operation and the areas on its periphery.

The most important map features a satellite image dominated by the scratched-out pit and its various dumps along the banks of the Strickland River, rendered as more of a muddy swamp due to the mine’s pollution. A series of yellow lines criss-crosses the photo, dividing the area into hundreds of small segments, each representing a territory belonging to a clan or sub-clan. If PJV had a defining problem, it was the illegal raiding of the pit by local clan members who existed within the Special Mining Lease (SML), the area on which Barrick is allowed to operate. Along twisted roads that reveal a botanical mash-up of the Caribbean and the Andes, 3,000 Porgerans negotiated a grim existence within sight of a refinery from which 19 million ounces of melted gold had been poured.

It was a problem that Placer Dome should have seen coming. “Placer was born in this country,” Greg Anderson, executive director of the PNG Chamber of Mines, told me. “It was a penny-stock company that came in the 1920s.” The company won the right to work a large alluvial deposit in the Bulolo region, which produced 1.3 million ounces of gold before closing in 1965. When Placer returned in the 1980s to make a play for Porgera, it negotiated as an old hand, not as an outsider.

But negotiated with whom? At no point in their history have Papua New Guineans constituted a single tribe or culture. Though their land is less than half the size of Ontario, with just 7 million inhabitants, it nevertheless features one of the most decentralized political systems on Earth. There are 854 recognized languages here (twelve of which are spoken only by ghosts), and an additional 3,000 dialects—Babel in the jungle.

Each tribal unit is referred to as a “society,” and has a distinctive language, culture, history, jurisprudence, and land policy. Although all PNG tribes have faced the same pressures—colonialism, the resource curse, climate change, the breakdown of old ways—there is nothing to be found here that resembles an esprit de corps. One thing all Papua New Guineans can agree on, however, is that wealth and social cohesion are determined by the possession of land, women, and pigs.

Fighting for resources is a way of life here. And when the PJV gold rush kicked in, everyone demanded a piece. The valley’s population increased from 6,000 to 50,000 in just a decade. The SML, which had been occupied by no more than a few hundred people during exploration, was, according to Barrick’s estimates, suddenly home to around 3,000. These people are referred to by the Ipili, one of the largest tribes in the region, as epo atene, or “those who have come”—hardly a term of endearment. At war with one another, at war with the mine: volatility defined the valley.

The main question that Placer, and later Barrick, had to answer was, who among the people of the valley was owed how much? Loosely speaking, Porgeran social organization adheres to a “cognatic” system, by which inheritance rights can be accrued through both matrilineal and patrilineal affiliations, while kinship must be achieved and maintained either by verbal or physical suasion. Confused? So was a massive Canadian mining company, which goes some way toward explaining why Placer Dome allowed the clans to continue living on the SML, an area that, in a more standard international leasing arrangement, would have been declared an exclusion zone. Consequently, because of intersecting clan allegiances, it’s been nearly impossible for Barrick to determine who “belongs” on the site.

In the twenty-six years since industrial mining began, none of these issues has been resolved—in fact, they have become only more convoluted. At PJV headquarters and out in the community, an ambitious “land-resettlement program” is the current obsession. Managed by a social scientist named Richard Savage, and undertaken with the buy-in of the PLOA, pilot projects have been implemented to determine how to move the clans off the SML, and where in the crowded valley to move them. The anticipated costs of the venture could run into the tens of millions.

Complicating all this is the fact that PNG is one of the more dangerous, if not the most dangerous, countries in the world in which to be female. According to the most recent UNICEF report, released in 2012, “the Maternal Mortality Ratio (MMR) of 733 per 100,000 live births is the second highest in the world,” and only 57 percent of women consider themselves literate. These inequities are the symptoms of a culture that sees shocking levels of violence committed against women and girls. One study found that two out of three women had been beaten by their husbands, while another reported that the first sexual encounter for one in five women was rape. According to a study of 3,000 victims that was conducted by Médecins Sans Frontières and shared with the Huffington Post, “Over half of the survivors were children. One in six were under the age of 5.”

Yet even within this environment of normalized sexual violence, what was happening on the PJV was unusual. There has been disagreement about how many women were harmed, but the stories were everywhere—they had become part of the narrative fabric of the valley. The head of the Family Violence Unit told me that he once came across a naked eight-year-old girl who had been assaulted on the banks of the Strickland; he had to take her, bloodied and weeping, to the clinic. A human-rights worker told me of a woman who had been attacked while carrying her baby. As the mother was being gang-raped, the infant fell into a shallow pool and drowned. Engan customary law obliged her to compensate her husband and his family for the loss of the child.

And then there was this incident, which occurred in January 2009. As told to Human Rights Watch:

I was also trying to run away but I tripped on a stone and I fell down. Six security [personnel] held me. Their reaction was not to take me to jail but they were trying to rape me and holding on to my skirt and pulling it like they wanted to take it off. I bent down holding my skirt and one security kicked me in the face. I lost my five bottom teeth and three top teeth. After that, these security raped me.

By 2009, Porgera Valley resembled an alt-horror version of the Wild West. Scowling men stalked the streets of Porgera and nearby Paiam with bush knives dangling from their belts, while women scurrying home with their babies made sure they were indoors before dark. In order to quiet the insecurity, the PNG government, after a report was sent by the mine, sent four units of their dreaded mobile squad of police to maintain law and order.

If the mess in the valley had a locus, it was, according to PJV security guards, a small village called Wuangima, located in the SML. Barrick personnel say the village was the staging ground for mining raids on the pit. “Every night, you could hear the rapes,” a high-ranking security operative told me. “Do you have any idea what that sounds like?” In April of that year, a fire reduced Wuangima to a series of ashy circles. The flames were clearly visible from PJV headquarters. An Amnesty International report suggested that Barrick was guilty of using police to force evictions by way of arson—an allegation the company forcefully denied. “Virtually every ‘fact’ recited by [Amnesty] was either without foundation or unfairly painted a picture of this action by PNG police and Barrick that is fundamentally misleading,” read Barrick’s official statement.

Whoever was responsible, the tactics worked. The valley’s murder rate plummeted, the open pit experienced a decline in illegal mining activities, and local women felt safer on the streets. But Wuangima would turn out to be just one of the PR problems Barrick faced in 2009. By this point, the stories about systematic sexual abuse had leaked into the press. Enter a trifecta of NGOs, all of which had been monitoring the behaviour of mining companies for at least a decade.

Perhaps the most prominent at the time was a research team, led by a legal scholar named Sarah Knuckey, that was associated with the human-rights centres of Harvard, Columbia, and New York University’s law schools. In Porgera, it had no trouble finding victims. The team submitted evidence of eight rapes and two other acts of sexual violence to the Canadian government, and the testimony was laced with gruesome details. “The story starts with Barrick not doing due diligence in hiring security,” Knuckey told me. “It continued with the company’s lack of attention to what people were alleging.”

Barrick isn’t alone. Other Canadian mining companies listed on the Toronto Stock Exchange have been associated with child labour, slavery, environmental damage, mass sexual assault, and mass murder. Despite all of this, the relationship between the mining industry and Ottawa remains entangled. Former prime minister Brian Mulroney serves as the chairman of Barrick’s international advisory board—his previous position, as senior advisor, earned him over $2.5 million in 2012. When John Baird, former foreign minister under Stephen Harper, abruptly quit his post in 2015, he practically walked from his office in Parliament to a seat on Barrick’s advisory board. And Canadian diggers don’t restrict their recruiting to outgoing Canadian politicians. Former United States president George H.W. Bush served as an honorary senior adviser to Barrick’s international board, while former Speaker of the House of Representatives Newt Gingrich was tapped for a seat.

Given the links between Big Mining and its government benefactors, it’s perhaps no surprise that free-trade agreements—through which Ottawa conducts policy beyond its borders—help inoculate locally registered corporations against prosecution outside Canada. As Anna Vogt, a policy analyst for the Latin American and Caribbean region, noted in a blog entry, “Laws and regulations currently in place favour the activities of Canadian companies abroad above all other considerations.”

Canadian mining houses pumped $71 billion worth of taxes and royalties into our economy in the decade leading up to 2012, and billions more into nations—many with poor human-rights records—that have lacked the capital and the skills to access their own resources. Much of that money flows back to Bay Street, which likely helps explain why the Export Development Canada, along with the Canadian Pension Plan, provides an estimated $20 billion in financing and insurance sweeteners to the industry every year. Big Mining has engaged in a series of shotgun weddings: small players are being bought up by increasingly consolidated transnational corporations that wield immense lobbying power. Perhaps nothing exemplifies this phenomenon better than Barrick itself; the company acquired Placer Dome for $10.4 billion in late 2006. The combined assets of this Canadian power couple made it the biggest gold-mining company at the time.

Shortly after the Placer/Barrick marriage was consummated, a series of consultations took place in Ottawa, culminating in the 2007 National Roundtables on Corporate Social Responsibility and the Canadian Extractive Industry in Developing Countries. The sessions were, according to a report published that year, “organized by a Steering Committee of Government of Canada officials working closely with an Advisory Group comprising persons drawn from industry, labour, the socially responsible investment community, civil society and academia.” This supergroup’s stated aim was to devise a “Canadian CSR framework”—a policy outline that would encourage members of the Canadian extractive sector to behave like responsible global citizens.

Such a policy was in the industry’s own interests. The enmity between miners and anti-mining activists aside, restive operation sites and mass-murder allegations are not good for business. For at least two decades, the extractive sector and other multinational industries had been trying to figure out how best to regulate themselves in countries with scant government oversight and little, if any, rule of law. Since the 1970s, Big Mining has been developing ethical best practices that have led to overarching, and entirely voluntary, frameworks. These policy outlines influenced how miners spoke about values, even if they didn’t always change outcomes.

In order to manage what it described as “security and human rights related risks” at its mines, Barrick in 2007 adopted the latest of these frameworks, termed the Voluntary Principles on Security and Human Rights (VPSHR). As always, the principles were not binding. In Barrick’s case, even the “compulsory” biannual site audits were not made public but were instead “utilized strictly for internal purposes.”

Barrick then doubled down and became one of the first multinationals to sign on to the United Nations Guiding Principles on Business and Human Rights (UNGPs)—a super-charged version of the VHSPR, enacted in 2011. Notably, in the case of PJV, the UNGPs insisted that there should be “access to remedy for victims of business-related abuses.” But in the face of what were potentially hundreds of cases of gang rape, the UN’s demands seemed feeble.

The 2007 roundtable coincided with the rollout of these larger multilateral initiatives. But a central question remained: In an international trade environment that protected transnational companies from any real liability in foreign territories, didn’t the federal government have an obligation to police corporations registered in Canada or listed on its stock exchange? Human-rights advocates were clear in this regard, but agency more often than not lay with the sovereign national governments that invited Canadian miners into their countries. “How do you operate in such an environment as PNG?” a local commentator and politician named Alan Bird asked me. “You can’t blame the miners. It’s pure capitalism.”

Be that as it may, something had to give. The roundtable’s recommendations suggested that ministries of foreign affairs or industrial trade, through the office of an independent ombudsperson, should investigate complaints emerging from developing nations. The ombudsperson would have the ability “to provide advisory services, fact finding and reporting regarding complaints with respect to the operations in developing countries of Canadian extractive companies.” If a mining house failed to meet the CSR framework’s standards, noted the report, “government support for the company should be withdrawn.”

As tough as that might have sounded, the roundtable didn’t call for criminal charges to be laid against law-breaking executives. It also naively asked for the Canadian government to “help” developing nations form better governance institutions, as if Manila or Moscow were waiting for Ottawa’s advice on how best to police their extractive sectors. Despite these shortcomings, the roundtable did provide the guidelines that led to Bill C-300, also known as the Responsible Mining Act, which was drafted in 2009 and tabled a year later by John McKay, a Liberal MP representing Toronto’s Guildwood–Scarborough riding. The legislation was defeated 140 to 134 in the House of Commons in October 2010, largely because members of parliament faced unrelenting pressure from lobbyists, including former Liberal international trade minister Jim Peterson.

The defeat of Bill C-300 was seen as a major setback in responsible-mining circles, in no small part because of the events that had transpired at PJV. As the first of the roundtables was taking place, a community outfit called the Akali Tange Association released a report called “The Shooting Fields of Porgera Joint Venture: Now a Case to Compensate and Justice to Prevail.” The report alleged that private PJV security guards had shot and killed at least nine locals between 1996 and 2005, and had murdered several others by either smashing them with rocks or flinging them into the open pit. A number of these cases were impossible to verify, but on the eve of its nuptials with Barrick in November 2005, Placer publicly acknowledged eight deaths, although it held that its security forces had acted in self-defence. In a footnote, the report also cited something that would end up serving as a precedent: an agreement, signed between the families of one of the victims and PJV, that provided compensation in exchange for the preclusion of any further legal action.

Five years after purchasing Placer, Barrick faced its own human-rights nightmare. When the rapes became impossible to ignore, the fallout was relatively swift. There were firings, and testimony was handed over to the PNG police for investigation. (Barrick steadfastly refused to investigate the assaults, leaving that to local police. So far there have been no successful prosecutions.) Barrick turned to a man named Patrick Bindon for assistance. An unflappable Australian who answers the phone with a deep Queensland “G’day, mate,” Bindon has a long history in the industry, and he was now employed by Porgera as an all-purpose communications fixer.

In 2012, Bindon set out to provide Barrick with a process that would define what a corporation could offer in the face of human-rights violations—but would avoid any admission of liability and, more crucially, eliminate the possibility of further legal action. The program is called Olgeta Meri Igat Raits—pidgin for “All Women Have Rights.” In many respects, it was a game changer. “It was launched to a lot of fanfare,” Knuckey told me. “What was unique about it was that it came out right after the UNGPs, which stated that if human rights are violated, the company needs to provide a remedy. Barrick appeared to be a company finally taking responsibility for its actions and offering compensation.”

The first step required a claimant to go to an office in Porgera Station and make a statement that would be assessed through a Complaints Assessment Team (CAT). (There were problems: in a valley rife with gossip, the simple act of making a claim outed a woman as a rape victim, and thus often exacerbated her problems rather than ending them.) The CAT went over the testimony and passed its assessment on to an independent expert, who prepared a decision. Claimants could appeal adverse findings, and they also had the right to engage an independent legal adviser, a local lawyer who dispensed free advice on a case-by-case basis. If the claimant accepted the remedy package, she would sign away her right to bring another case against Barrick or its affiliates.

The remedy packages offered a combination of cash, rape counselling, and business education. But because these packages were never appropriately explained to claimants, many of whom were illiterate, there was often confusion about the terms. By June 2015, 253 claims had been lodged, of which 119 have been paid out. To some human-rights groups, this didn’t seem like nearly enough. An American outfit called Earth Rights—which first touched down in Porgera in January 2013—set up a shadow remedial framework whose staff hoped to sue Barrick for larger compensation packages. It found thirty-six women willing to participate in the process, one of whom was Marawanda Wakapu. Earth Rights prepared to file a suit not in PNG, nor in Canada, but in Nevada, where Barrick has operated since the mid-’80s, and where courts tend to be less tolerant of white-collar crime. In 2014, Barrick settled, and eleven women, including Wakapu, won compensation substantially higher than what Barrick had offered—a result that led to the company revising its packages upward.

This was not, however, the watershed moment in Canadian corporate history many had hoped it would be. “At the time of the creation of the mechanism, there was zero direct consultation with the victims. It was designed without putting at the centre of it the people who were going to use it,” Knuckey told me. Her team had wanted a mechanism that would redress all of the crimes committed in the name of the mine, not just sexual assaults. “If you were beaten in the face, or were a man who was butchered, you couldn’t access the packages,” she said. Activists were looking for something fairer, something more encompassing—and something created alongside those most affected by the operations.

But Barrick took another view. “These organizations are external entities with nothing on the ground,” Temu told me. “They messed up our structure that we had in place. They don’t live here. They have no interest in the lives of the women, who have probably spent the money and are back to square one.”

Marawanda Wakapu was among those who found themselves back at the start. When we met in a Barrick boardroom, the money—the terms of the Earth Rights settlement required that the amount not be disclosed—was already gone. She had bought a bus in order to start a business. It sat on blocks. “I have nothing,” she told me, weeping. “What will I do now?”

If this was corporate social responsibility, then it wasn’t working. At a Tanzanian mine called North Mara, which had seen enormous rates of community violence when it was owned and operated by Barrick Africa between 2006 and 2010, a similar framework had been put in place, but the company had again negotiated a waiver inhibiting further legal action in exchange for compensation. While in Canadian and other Western legal systems this sort of process is de rigueur, such compensation frameworks end up bring poorly understood, and communities—fairly or unfairly—often demand more.

Had Barrick’s considerable efforts led to a fairer, more reasonable transnational corporate-governance framework? Few people seemed to think so, and the problem of the mean ungreen multinational did not seem to have been solved. Even The Economist, a reliable cheerleader for transnational companies, recently published a story titled “In Praise of Small Miners,” in which it celebrated the economics of “artisanal mining.” As with artisanal charcuterie or knitwear, the smaller-is-better trend is predicated on a localized economic model that provides benefits to the lowest rungs of society, rather than to the highest. But without stringent top-down governance, and a functioning and policed set of regulatory frameworks, does it matter whether mining is big or small?

The PNG government, of course, can run the country however it sees fit. “MiningWatch would say, ‘Stop the mining,’” Temu told me. “But what would we do as a country? Resource extraction was a deliberate decision by a sovereign country to use its resources to fund its development. Who the hell are they to tell us what to do?” Still, Port Moresby has signed on to the Extractive Industries Transparency Alliance and taken some small steps toward cleaning itself up. (That said, students protesting O’Neill’s corruption were recently met with gunfire, and seventeen were injured.) Meanwhile, new allegations have emerged in the valley: three men, one of whom was HIV-positive, claimed to have been forced by PJV guards into having sex with each other. “We have received WhatsApp messages of some new cases,” Knuckey told me. “We went back in December, and we reported some of these new cases to Barrick and to the police commissioners in Port Moresby and to the ombudsman office. We haven’t heard back from Barrick.”

That might be because Barrick has tried to move on from the assault narrative and is staking the future of the PJV and its people on the land-resettlement program. During my visit it was deeply involved in a delicate series of consultations with the community, with an eye to rebuilding a whole world for the clans moving off the SML. “You’re worried about where they’re going, the livelihood restoration, economic ability, water, sanitation—all those sorts of things,” Richard Savage explained. This was nothing short of nation building for 3,000 people—a vast CSR intervention that would profoundly alter the region’s social makeup. But there are no guarantees that resettlement would end the almost three decades of violence that have defined PJV’s life in the valley, and the timeline for implementation remains murky.

Looming over all this is a final question: As far as Big Mining is concerned, are problems like these really problems at all? Despite the misery, blood, and treasure expended at Porgera, Barrick claims the lowest cost of extraction per ounce of gold in the mega-mining industry. The Economist’s assertions aside, bigger works best. Because the company can spread operating costs, sophisticated mine-management processes, and, most important, risk across its disparate territories, it’s able to spend much less to mine gold than does the competition: almost $130 less per ounce than the median. This translates into bigger margins, as well as larger dividends for shareholders. Run a cost–benefit analysis, and the trouble in the valley becomes barely a rounding error on a spreadsheet.

This appeared in the November 2016 issue.