In 2014, Kervin and Kyra were earning more than ever. The two professionals—Kervin is an accountant, Kyra* a sales coordinator—immigrated to Canada from their native Mauritius in 2010, seeking a better life. To all appearances, their hard work had been rewarded. They had a Toyota Corolla and a Mazda 5 in the driveway, and were paying down a new townhouse in Surrey, British Columbia. “I was considered successful,” says Kervin. “People might have thought I had a few debts, but nothing I couldn’t handle.”

Listen to an audio version of this story

For more Walrus audio, subscribe to AMI-audio podcasts on iTunes.

One year later, creditors were calling daily. Kervin and Kyra’s combined after-tax monthly income of $7,300 should have been enough for them to get by—the couple had few extravagances. But they had debt—more than $150,000 of it. A lot of that was because of the credit cards and credit lines Kervin had used to carry his family through a rough patch that began in the spring of 2014, after the birth of their second child, a daughter. Kyra needed a C-section—major surgery with a lengthy recovery period. With no family nearby to help, Kervin took a three-month parental leave from his accounting job at Schneider Electric, a European multinational. “I felt I owed it to my wife,” he said. “Since I came to Canada, I’d been working hard. I didn’t have a chance to connect with my family at all.” To get the time off, he set up a job-sharing arrangement with two less senior employees. It came with a risk, and, sure enough, he returned in June 2014 to find that his job was gone. His duties had been transferred to the other staffers.

Kervin didn’t sweat it at first. He was given an $11,000 severance package (two months’ salary). He cashed in his company shares, worth $8,000, and the couple had $12,000 in savings. By July 2014, Kyra had fully recovered, and Kervin began a contract that was slated to last until February 2015. He was hired as the senior accountant for a logging company in Osoyoos, a tiny village four hours’ drive from Vancouver. The couple decided to settle in Penticton, which would mean a forty-five-minute commute from work. Around Christmas, they decided to take the children to Mauritius to visit with family. That trip cost them $12,000, shaving their nest egg down to $9,000. Kervin wasn’t worried. He had his job to return to in January and was confident he’d find work when the contract was up in February. “I’ve always been an optimist,” he says.

But when they returned from Mauritius, Kervin found that his boss had lost a major client and could no longer afford to keep Kervin on the payroll. The couple moved to their current home in Surrey, where they rent-to-own for $1,700 a month. January passed without work, then February. Kyra returned to a full-time job as a sales coordinator. But with Kervin still unemployed, the rest of his savings evaporated. “Rent, groceries—everything is costly,” says Kervin. “You get your paycheque, and you don’t know where it goes.”

By the end of January, the money was gone. They put their daughter in daycare and their son in after-school care, but needed to come up with $900 to cover both. The couple walked into the Cash Store on 72nd Avenue in Surrey and got their first payday loans—$450 each, with annual interest rates nearing 590 percent. “It wasn’t easy to give the daycare that money, because you know how costly the fees will be,” says Kervin. The loan helped them get through the month, and they flew in Kervin’s mother, and then his father, to help take care of their kids. They paid for his mom’s flights, which came to $2,000.

Finally, Kervin found work—a two-month contract that lasted from mid-March to mid-May 2015. But by then, the couple had more than $156,000 in debt that they hadn’t been able to service since February. In the few years since they had moved to Canada, their monthly payments on credit cards, lines of credit, and payday loans had grown from $1,000 to $5,720. “We could have taken a basement apartment and saved $600 a month on rent,” says Kervin. But Kyra is allergic to dust and living in a basement would have been a struggle. They could have gotten rid of a car, but that would have meant that one of them would have been forced to travel by bus, adding hours of travel time to their busy days. They could have gotten rid of their cellphones or their home internet, but that would have made Kervin’s job search difficult, if not impossible.

And the bills kept coming. The phone rang constantly: first creditors called, then collection agencies. “Most of the time, I just didn’t know what to tell them,” Kyra recalls. The stress ate away at the couple’s relationship. They tried to support each other but found themselves, after the kids went to bed, having long, sometimes heated discussions. “We had debt everywhere,” says Kervin. “You don’t know what to pay first.” The couple agonized over whether to make payments for daycare or groceries, credit cards or cars.

Kervin found work again in June. But by then, they were in arrears with their payments to CIBC, and, at the end of August, the bank began garnishing their wages. BC Hydro was threatening to disconnect the power. Kervin settled into a stressful routine. After his workday, he would come home and spend hours on the phone negotiating with collection agency representatives—repeating the same information to a different caller each night. “We just want to know how you’re going to pay,” the callers would say. One collection agent encouraged him to take out more payday loans to cover the payments. Because of that advice, Kervin and Kyra ended getting six of them over the course of five months—for a combined total of $7,935.

The couple’s joint, after-tax annual income was almost $87,600, but they couldn’t keep up with the backlog of debt. Kervin, a diabetic, had gained twenty pounds. He couldn’t sleep. He began having heart palpitations and panic attacks. The couple argued incessantly. “I felt if I continued this way,” says Kervin, “I just might break.”

Kervin and kyra are hardly unique. Canadian households are now carrying more debt than those of any other G7 nation. By the end of 2016, Canadians owed a total of $2 trillion in mortgages, consumer credit, and loans. Millions of us now report living paycheque to paycheque, spending almost everything we make.

The reason our debt level is so troubling to economists is that we appear to be nearing a breaking point when it comes to our ability to manage it. In a recent survey by Canadian Payroll Association, almost 48 percent of respondents admitted they wouldn’t be able to make ends meet if their paycheque were late even by a week. Canadians, in other words, don’t have much of a cushion to handle an economic shock—such as a jump in interest rates or a loss of income. Yet thanks to all the cheap credit being doled out by banks, many of us can bridge our financial shortfalls for years before realizing we are on the brink of ruin.

Last year, the federal government’s Parliamentary Budget Officer (PBO) predicted that the moment of reckoning for our borrowing binge will come in 2020. That’s the year when, according to PBO forecasts, the percentage of disposable income that Canadians spend servicing debt will hit 15.9 percent, up from 14.1 percent today. In that scenario, “the financial vulnerability of the average household would rise to levels beyond historical experience.” It’s difficult to say what would happen next. A banking panic? An economic slowdown as spending stops? For Louis-Philippe Rochon, an economist at Laurentian University in Sudbury, Ontario, the number to watch is the interest rate, which PBO anticipates will return to “normal levels”—rising from the current crisis-era 2.5 percent to 5 percent. “That’s going to translate into several million defaults and problem loans and mortgages,” Rochon said. “It’s going to engineer a crisis. We’re in a very, very sensitive time.”

But such warnings may not do much to change our behaviour. Rochon argues that economic anger has itself become a spending trigger—retail therapy on a vast scale. “There’s certainly a level of frustration,” he says. “People are working more than before. People are more tired. There’s an idea that ‘I deserve a vacation.’ Or ‘I deserve a nicer home.’”

Indeed, while the largest chunk of our household expenditures goes toward groceries, transportation, and shelter, many Canadians seem uninterested in prioritizing needs over wants—according to a recent CIBC poll, only half of those surveyed were willing to cut spending on non-essential items in order to keep up with bills. Our debt load is, in a sense, the result of an aspirational burden. “Middle class” once meant exactly that—the median in household net worth, or the point at which half the population has a higher income and the other half a lower one. A 2013 internal government document deemed middle-class incomes to be anywhere between $54,000 and $108,000—that’s quite a spread. Middle-class status has thus become more of a state of mind than a demographic bracket. Federal finance minister Bill Morneau recently admitted as much, defining middle-class Canadians, in part, according to the “lifestyle they aspire to.”

But it’s hard to deny the fact that such lifestyles tend to be defined by consumption, or what one American sociologist has dubbed “upscale emulation.” A bankruptcy lawyer I spoke with has helped clients in just this fix—clients such as the Toronto architect crushed by $105,000 in tax debt and $75,000 in credit card debt who still managed to vacation in the tropics four times a year with his wife. Or the divorced, self-employed Toronto chiropractor who made $4,900 a month and insisted that both her kids attend private school—until the Canada Revenue Agency froze her accounts. We spend our way into the standard of living we feel we deserve, buying stuff that makes us who we think we are, or want to be.

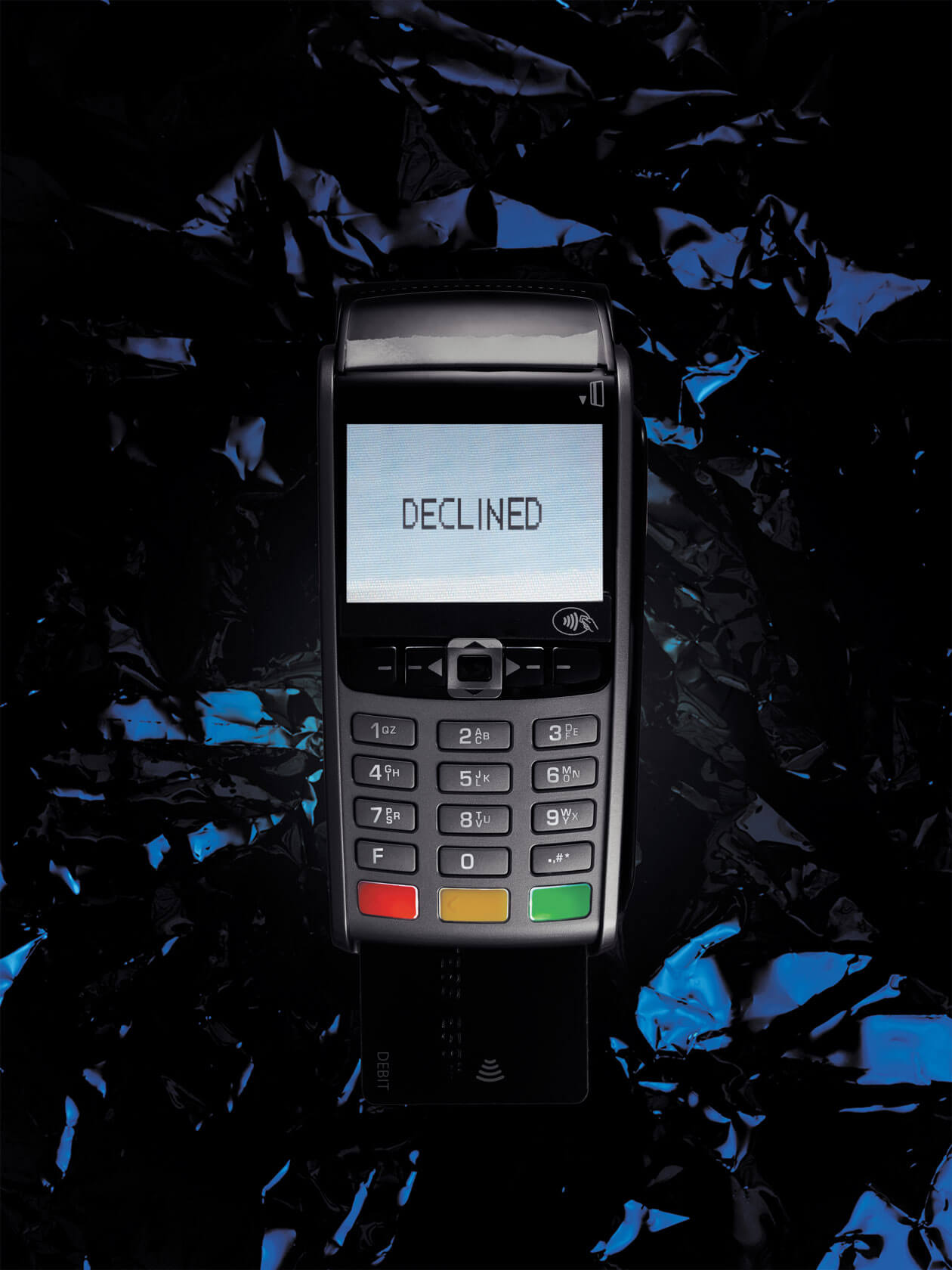

“We believe it’s our God-given right to have our $2.50 Starbucks coffee every morning,” says Alex Levine*, a senior strategist with a top Toronto ad agency. Levine plans campaigns for the major credit card companies, and, in the process, sees research on what Canadians want. Smartphones, laptops, and tablets. Designer water bottles. Organic vegetables and fruit. Cottage retreats, summer camps, and activities for kids. After-school tutors. Individually, these may not be major expenditures—but they add up. And more than ever, we use credit cards to cover them. In fact, we use plastic for almost everything, no matter how minor the item. And this convenience makes it easier for Canadians to spend beyond their means. In 1977, Visa and MasterCard processed 118 million sales in Canada, on a total of 8.2 million cards. That worked out to an annual average of fourteen purchases per card. By 2015, purchases had rocketed to 3.9 billion on 68 million cards—about fifty-seven purchases a year per card. Today, 44 percent of us can’t pay off our cards in full at the end of each month, and carry an average balance of $3,954. “Debt by a thousand pinpricks,” Levine calls it.

For now, it’s relatively easy to find the money for it all, thanks to our historically low interest rates. One Torontonian I talked to, a social worker who earns $50,000 a year, was offered a $20,000 line of credit on her four-bedroom detached home, and three credit cards with limits of $10,000 each. She took it all and financed things she felt her family needed from the Brick—beds for two kids, a flat-screen TV, a sofa—at prices she could never otherwise have afforded. Credit is no longer a convenience: it’s a lifeline. Messages such as “You’re richer than you think,” (Scotiabank’s long-standing slogan) and loyalty programs that convince us we’re actually earning money by spending it have helped change our relationship with debt. “We’ve turned debt from a bad thing into a good thing,” says Levine. And Canadians are addicted.

What’s driving our addiction is the fear of missing out—or FOMO. In a 2015 report commissioned by the PR agency Citizen Relations Canada, 64 percent of those surveyed acknowledged feeling envy and disappointment when confronted by other people’s successes; 56 percent of those between the ages of eighteen and thirty felt the pressure to “live large” in order to keep up with their peers on social-media networks. The study also revealed that when parents see other families enjoying certain experiences or products, FOMO drives them to imitate those spending patterns—which could involve paying for multiple vacations a year, backyard trampolines, or participation in representative (or “rep”) sports.

Rep sports are the most competitive and time-consuming levels of Canada’s estimated $5.7 billion youth sports market. Kids try out, or are recruited, for teams ranked by skill level and age group. Many families regard joining such community-based leagues—which often involve entry fees, several hours a week of practice time, and elite coaching—as a necessary first step in a talented child’s journey to the pros. According to a 2014 Canadian Youth Sports Report, 60 percent of kids between the ages of three and seventeen are enrolled in sports such as hockey or baseball—and for the families who take their rep sports seriously, the financial cost can be steep. Yet many are undeterred. Indeed, 30 percent of the parents recently surveyed by the marketing firm Léger revealed that they, or someone they know, used a credit card, drew from a line of credit, or even raided their retirement savings in order to pay for their children’s extracurricular activities.

Steve* and Jennifer*, who rent a home in a west-end suburb of Toronto for $1,700 a month, didn’t think pickup sports were enough for their two boys. Both are involved in rep hockey and rep baseball, activities that set the family back nearly $10,000 a year. That’s a prohibitive amount for almost any income bracket, but it’s particularly hard for Steve and Jennifer: she stays home with the kids, and they live off his salary as a carpenter. Jennifer, who once worked at AT&T earning $34 per hour, left the workforce fifteen years ago, a few years before her first son was born. “All my money would have gone to daycare anyway,” she recalls. Still, even though the family budget is tight, hockey and baseball remain a priority—“Especially baseball,” says Jennifer. “That runs in our family. Steve’s dad was drafted for the St. Louis Cardinals, so there’s a bit of talent there.”

From the beginning, something always required money: out-of-town tournaments, off-season training camps, club fees, new equipment when the boys grew out of the old gear. They paid in instalments, never missing one, even as they ignored their mounting tax bill. “Why do it? They were asked to play for AAA,” she said, referring to the highest level of minor hockey, “and you’re like, ‘so-and-so went over there, so maybe we should, too.’ There is very much a ‘keeping up with the Joneses’ aspect with parents and their children.” Soon, compound interest caught up with them. Their tax bill was $80,000 in 2013, and they had another $8,000 on credit cards. They were buried in debt.

In 2013, they went into consumer proposal, a process that involves consulting a Licensed Insolvency Trustee, who helps debtors strike a deal with their creditors to pay down a manageable portion of their outstanding unsecured debt. In 2016, 62,500 Canadians entered such agreements, which is half of all of the insolvencies declared last year (creditors prefer the consumer-proposal arrangement because it allows them to pocket more money than they would if a family were to declare bankruptcy, and debtors see it as a viable alternative because it allows them to hold on to assets they would otherwise have to sell). Steve and Jennifer negotiated a settlement and will keep making monthly payments until 2019. To help cover the costs of the rep sports, Jennifer recently started a home business printing T-shirts and jerseys; children’s sports teams are among her clients. But with no savings, no RRSP, no pension (other than CPP), no house to sell, and all of their income going to bills, they may need to rely on the $100,000 inheritance from Steve’s parents to make any retirement dreams a reality.

Marc Cohodes is sympathetic to the challenges faced by couples such as Steve and Jennifer. Cohodes—whom Bloomberg recently called “the scourge of Wall Street”—used to run one of the most successful hedge funds in the United States specializing in short-selling (he picked stocks he thought would tank, then made millions when they did). At fifty-six, he’s now a chicken farmer in Cotati, California, but he still monitors the markets, and he has trained his sights on Canada’s housing market and the debt people are assuming because of it. He points out that a large number of Canadians haven’t seen any gains in income, but nevertheless cling to the same consumer expectations. “They’re trying to keep up when they can barely run in place.” As a result, desires outstrip incomes, and many frustrated Canadians are left feeling they have no choice but to borrow. And the deeper they dig themselves into debt, the harder it is for them to climb out. “At one point,” says Cohodes, “you’re burning the furniture to heat the house.”

Money mart, Payday Loan Mart, and Cash Money represent just a few of the more than 1,500 payday loan stores that have sprung up across the country since the 1990s. Nearly two million Canadians turn to them each year.

Marketed as a way to deal with unexpected situations, the loans they offer help many keep up with debt repayments—they’re especially appealing to those who wouldn’t qualify for help from a traditional bank. But payday loan clients are not necessarily low-income—middle-income earners are also avid users simply because they tend to carry more debt. In 2016, 70 percent of borrowers made $80,000 or less; 7 percent made more than $120,000. The very use of such loans can be an early indicator of impending doom. According to a 2017 report by debt management firm Hoyes, Michalos & Associates Inc., a quarter of the people who end up filing for insolvency in Ontario took out payday loans, an 18 percent increase over the last two years. The average amount is said to be just under $900, but consumers are increasingly borrowing from multiple lenders. These loans are so addictive that some consumer advocates consider them the crack cocaine of the financial world. And, according to Hoyes, Michalos & Associates, many of the Canadians falling into their trap are single mothers.

Jacqui*, a fifty-one-year-old single parent in Vancouver, was done in by a bad marriage. In 1999, after giving birth to a son, she split up with the boy’s father. The couple had had a daughter a few years earlier, so Jacqui was now on her own with two children. She worked part-time as a correctional officer, but the long shifts and poor pay made her situation difficult to manage. She applied to a housing co-op for single mothers, and was accepted. It was exactly the tight-knit community she needed. Jacqui could always find someone to look after her kids when she had to work a long shift. The cost of living was low. There was a sliding scale for rent—you paid 30 percent of your salary, whatever that may be. Few of the children there wore new clothes. Instead of shopping at the mall, the mothers relied on seasonal clothing swaps. They had developed their own co-operative culture: a supportive, affordable micro-economy within a big city.

But the bliss of communal living sheltered Jacqui. All around her, Vancouver was getting more expensive. After having lived at the co-op for fourteen years, she got married and moved away. She got a new job with the local school board as a translator for deaf-blind children. She enjoyed the position more than her last one, and it had better hours. But her income, around $45,000, hadn’t changed much. Meanwhile, housing prices had shot up 159 percent, and the cost of living had skyrocketed along with it. When she moved in with her husband, she lost touch with the moms who had been her greatest support.

The problems with her husband started right away. “I thought he was the man of my dreams,” she recalls. She had turned a blind eye to his finances and learned only after the wedding that he had previously gone bankrupt. He asked her to help make mortgage payments on the house they shared, which was owned by his mother. Jacqui’s contribution to the mortgage ended up being much higher than the rent she had paid at the co-op—and there were new expenses: clothes for teenage kids and groceries for what was now a family of four. Her husband convinced her to buy a new car, which she financed but couldn’t afford. She blew through her savings—$10,000—in their first year together. And she kept making payments. “I didn’t want to ask him for money. I just wanted it to work,” she says.

To avoid conflict, Jacqui began paying more than she could afford, putting purchases on her credit card in hopes that their financial state would improve. And there were other problems. Her son, then thirteen, sustained a concussion during a football game and as a result, missed a lot of school and sank into depression. One day, the anger boiled over. The couple fought and Jacqui’s son intervened. The police were called. Jacqui got herself and her kids out, leaving behind any money she’d paid toward the house and their life together.

Broke and on her own again with two kids, a cat, and a dog, she couldn’t find an affordable place to live. Women’s shelters refused them: none would allow pets. They stayed for several weeks with Jacqui’s mom, until she found a basement apartment for $1,200 a month. The place was dingy, mildew-stained, and small, but Jacqui was desperate. Cheap as it was, however, she couldn’t afford it. Her other payments—car, credit card—were adding up. Like Kervin and Kyra, and at least 200,000 other people in BC that year, Jacqui sought a quick fix with payday loans.

But she was always stuck playing catch-up from the month before. As the late payments piled up, she found herself fielding calls from CIBC’s collection agents—they phoned her in the morning before work and in the evening when she came home. Many were men she found verbally abusive. One of them told her to sell her car. One hardened collector asked, “What kind of mother are you, anyway?” The remark cut deep—Jacqui still tears up when she thinks about it.

A study out of the United Kingdom found that the greater the debt load we carry, the more we’re subject to depression, anxiety, and other mental health issues. Jacqui was working full-time; she needed her car for work. She already had the cheapest apartment she could find in an expensive city. Her daughter was nearing university age, and Jacqui couldn’t afford to cover school expenses. She didn’t know how to get her family out of debt. She became desperate.

As she was about to cross the street one day, she watched the traffic zoom by, and an idea occurred to her: she could cash in her life insurance. Jacqui had taken out a $100,000 policy for death or dismemberment. She stood on the street corner and thought, “I should just run into this traffic. Everyone would be better off.” Maybe she’d be terribly injured or die. But their money problems would be over. The light changed then, and she crossed safely. Shortly thereafter, she ran into a friend while picking up her son from school. The friend told her she looked like hell, and Jacqui shared the whole sordid tale. The friend said, “Oh, we had financial trouble, too. We declared bankruptcy.”

Jacqui took the name of the trustee her friend had worked with and later went into a consumer proposal. Today, things are still tight financially, but at $20,000, her debt is comparatively small. Without creditors hounding her, she’s in a better place psychologically. Her daughter is now working and paying her own way through law school. Her son still has concussion-related health problems, but she expects him to soon attend college. As for big banks and credit cards—“I’m done with them,” she says. Instead, Jacqui wants to start a credit collective for single mothers.

When troubles come, and you’re living on borrowed money, it doesn’t take much to tip the scales. For Kervin and Kyra, the deciding event was the loss of one spouse’s job. For Steve and Jennifer, it was the decision to ignore their tax bill while shelling out for rep hockey and baseball. For Jacqui, it was a relationship gone wrong. And there are many others just like them, teetering on the edge. Check the Twitter feed of Scott Terrio, an estate planner with Toronto insolvency firm Cooper & Company, and you’ll find daily examples: “Young couple spending total $2,800/mo on two new, financed cars. They make $6,000/mo avg net income. So 46% of disp income.#cars #debt,” Terrio tweeted on April 5. A day later, someone else with an equally disturbing story walked into his office: “$108,000 in credit cards in the last 2 years, hasn’t worked for 5 years (on disability $900/mo).”

One thing is certain about our debt: at some point, we will have to settle up. Canadians rarely stop and think about the fact that the primary goal of a bank (making a profit) isn’t necessarily aligned with the chief concern of consumers (affording life). “Consumers think, ‘The bank’s looking out for me,’” says Blair Mantin, a bankruptcy trustee with Sands & Associates in Vancouver. “They think, ‘The bank wouldn’t have loaned me this money if they didn’t think I could pay it back.’ Those days are gone. Aggressive sales targets mean selling clients products whether it’s in their best interest or not.”

Kervin and Kyra have decided that, for now, it’s not. After Kervin’s consumer proposal was accepted, his debt payments were consolidated into a manageable monthly amount. No more calls from creditors. No more panic attacks. He also found stable work—as a financial controller at a collection agency. “It’s a funny situation,” he acknowledges. The hunted has become the hunter. Kyra is now earning double what she made when she first came to Canada.

But they’re still living very close to the wire. “I wouldn’t say it’s paycheque to paycheque,” says Kervin. But it is: the couple now nets $7,738 each month. After putting aside $100 for their children’s RESP, half their income goes to pay for debts ($3,554), childcare ($800), and the Mazda and Toyota (leases, insurance premiums, and gas for the long commutes to work add up to about $1,600). The rest of the money goes toward such necessities as rent ($1,700), utilities ($400), and groceries ($600). Once all the bills are paid, the couple is left with a monthly surplus: two bucks. “It’s not like we’re living our dream,” says Kyra. “But we can’t complain.”

*Names have been changed.

This originally appeared in the June 2017 issue under the headline “Maxed Out.”