I went to see my auto insurance agent Steve a couple of weeks ago.

“Sir, as your accredited automobile insurance agent, my primary objective is to make you feel secure. So I’d like to offer you our newest policy: a policy on your policy.”

“Come again”

“Well, as you can see from this handy pie chart I’ve drawn up, it’s an idea so simple, so perversely apparent, that even a monkey could understand it: you should insure your insurance.”

Steve made a strong point. I had never considered how truly vulnerable my insurance policy was. What if I got in an accident Why, my premiums would soar! But if I insured my current premium rate, an accident claim wouldn’t affect my monthly outlay. No sir, I was no monkey. I signed the papers and gave the man my fifty bucks.

Immediately, a powerful sense of calm settled over me. I left Steve’s office, crossed the street without looking either way, jumped in my car, and, seat belt brazenly unbuckled, peeled out of the parking garage.

I hit three telephone poles and a lemonade stand on the way home, in addition to what may or may not have been an old lady. I felt fantastic. Why Because I had peace of mind. That night, I slept like a baby, despite the fact that I was clearly still a fifty-seven-year-old man with chronic angina.

The next morning I went to see what Susan, my life insurance agent, had to offer.

“Well, there is one item that might, er, interest you,” she said with a wink that flagged her clever use of actuarial humour. “Near-death policies. They cover you in case you almost die. These babies are still at the prototype stage, hot out of the Dallas office. Technically, I’m not even supposed to sell this to you.”

“I’ll take it.”

And Susan, bless her healthy, functioning heart, drew up the papers straight away.

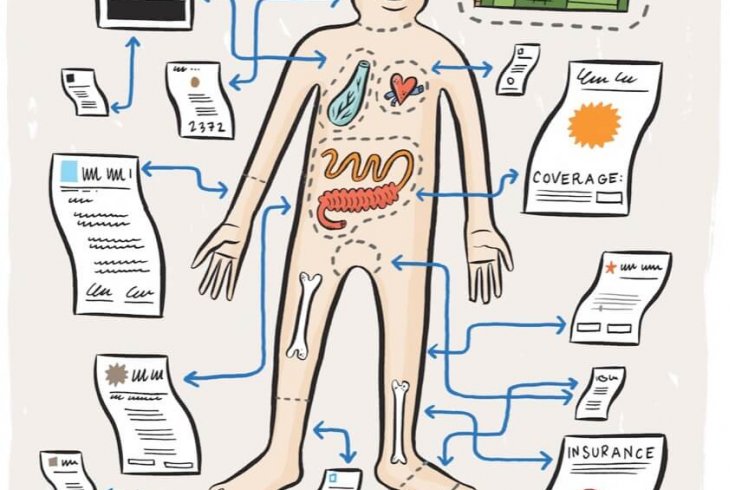

I spent most of the next week buying up all sorts of policies, my tiny bundles of guaranteed serenity. I insured my lungs, my brain, my faulty ticker. I took out a “sudden loss” policy on my appendix. I backed up my other cars, my neighbours’ cars, my kids, and my kids’ neighbours’ cars.

And I didn’t stop there. I insured my salary, my hard drive, my software, and my slippers. If I went on a bad blind date, it was eighty bucks in my back pocket. If my cellphone gave me cancer, I stood to earn over $2 million. And if my cellphone didn’t give me cancer, it would be a hell of a lot more.

I even convinced Lloyd’s of London to underwrite my right arm, in case those long hours of policy notarizing caused any permanent nerve damage.

After putting in so much time buying insurance, I eventually lost my job selling patio furniture. Of course, I had a rock-solid “lawful dismissal” policy for this very situation. I was covered—I was more than covered.

How had I overlooked the insurance game all these years I felt like my life to this point had been The Greatest Hits of Dean Martin minus “That’s Amore.” I’d missed out on an essential building block of comfort, been Old Man Fate’s impotent sparring partner for too long. But now I had a jab to which Papa Fortune had no counter: insurance.

By this point, I had so many layers of protection on my protection that Great White North Insurance informed me that it had no choice but to make me the new owner and sole proprietor of Great White North.

I checked the company books and, sure enough, the situation was dire: if I so much as stubbed my big toe at any time during the next 600 years, I’d bankrupt myself almost instantly. I had no choice but to flee the country and head straight for the New Mexico desert in my absolute death trap of a Volvo.

Bottom line: you can’t prepare for everything. As a wise man once noted, the only two certainties in life are death and taxes. Still, I’ve decided to fork over the extra ten bucks a month to Desert Sun Securities, on the off-hand chance that Ben Franklin was wrong.