Listen to an audio version of this story

One of the most notorious scenes in recent TV history occurs partway through season two of HBO’s Succession, when media magnate Logan Roy, played by Brian Cox, announces a game of “Boar on the Floor.” In the middle of an elaborate candlelit dinner in a Hungarian castle, the octogenarian founder and CEO of Waystar Royco orders three of his senior staff to crawl around on the floor while oinking like pigs. They then fight for scraps of food while other members of the leadership team laugh, chant, and take a compromising video.

The “Boar on the Floor” scene is dehumanizing, but it does not feel surreal. We believe these business executives would get on their hands and knees for their boss’s approval just as we believe he would take pleasure in making them do it. We accept the behaviour as realistic because, according to unwritten laws of human psychology passed down in narratives since Faust (whose pact with the devil involved exchanging his soul for worldly pleasures), you can’t aspire to unlimited money and power without surrendering part of your humanity.

Antipathy toward the super-rich is now a fixture of our politics, with the very wealthy getting it from all sides. On the left, billionaires are pilloried for their vampiric greed and obsession with frivolous luxuries. “They’re spending their time up in space, going on luxury rides in rocket ships,” NDP leader Jagmeet Singh said during the last federal election campaign. On the far right, billionaires are magnets for outlandish conspiracy theories involving microchips in your coronavirus vaccine (Bill Gates) or plots to establish a new global government (George Soros). Skepticism toward the uber-wealthy courses through the middle of our politics too: before she became Canada’s finance minister, Chrystia Freeland published a 2012 book titled Plutocrats: The Rise of the New Global Super Rich and the Fall of Everyone Else, which exposed the outsize political influence and dangerous insularity of the 0.1 percent.

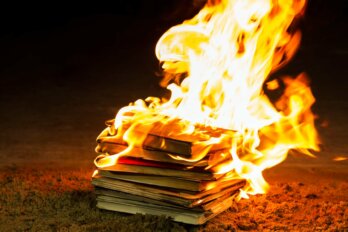

It was only a matter of time before the wealthy decided to strike back. Some have evidently had quite enough of being the public scapegoat for everything from poverty to the climate crisis. They’re done with the relentless public excoriation if not outright prejudice so often directed against their kind. And they have found their defender in Derek Bullen, founder and CEO of SI Systems, a Canadian IT staffing firm. Bullen’s new book, In Defence of Wealth: A Modest Rebuttal to the Charge the Rich are Bad for Society, intends to prove that, far from vilified for leeching the life out of society, rich people should be thanked for giving us a healthier, safer, more prosperous existence. It may well go down in history as one of the most self-damning documents in the annals of the rich.

Let’s start with some facts. We are living through an era of extreme and widening inequality in wealth and income. In 2017, Oxfam International reported that the world’s eight richest people had the same collective wealth as the 3.6 billion people who composed humanity’s poorest half. In the United States, the top 1 percent of households own more wealth than the bottom 90 percent. While not quite as dire, wealth inequality in Canada is just as real. The Parliamentary Budget Officer recently found that, when it comes to family net worth, the top 1 percent own a quarter of the country’s total wealth while the bottom 40 percent claim only 1.1 percent. COVID-19 further exacerbated these trends, visiting disaster upon the working poor while delivering windfalls to the corporate elite—according to Oxfam Canada, fifteen new Canadian billionaires have been minted since the pandemic began.

Still, could more billionaires be a good thing? In Defence of Wealth argues that, contra the progressive caricature of the wealthy as tax-avoiding, worker-exploiting parasites, rich people deserve credit for improving all of our lives. Bullen, a self-declared 1 percenter, frames his book as a vindication of the wealthy, who he argues have amassed their riches through ingenuity and hard work. From Bullen’s vantage, income inequality is irrelevant, and “the perceived conflict between the one percent and everyone else is one big distraction.” Why is income inequality a distraction? First, Bullen argues that the statistics on wealth inequality are overblown and that increased wealth for the rich benefits everyone because the rich pay taxes and provide jobs. Second, poor people are better off than ever before, largely because of the ingenuity and largesse of the wealthy. And, third, any attempt to redistribute wealth or curb inequality will have the opposite of its intended effect.

CEO compensation is a case in point. According to Bullen, such compensation has risen 940 percent since 1978 while average worker compensation has risen 12 percent in the same time. In 2020, the ratio of CEO to worker salary was 351:1. The reason for this disparity, according to Bullen, is that, in 1993, Bill Clinton tried to cap US executive compensation at $1 million, which prompted companies to redefine most executive compensation as performance pay in the form of bonuses and stock options. The real catalyst for skyrocketing CEO salaries, in Bullen’s view, was government meddling—not that Bullen has any problem with the exorbitant sums commanded by the C-suite. He argues that “everyone benefited” from their inflated pay packages. Why? Because “the majority of shares are owned by individuals—and when the value of their stockholdings go up [sic], it’s a win for everyone.” Bullen’s “everyone” does not include the 61 percent of Canadians who don’t own any stock.

Throughout In Defence of Wealth, Bullen seems convinced that anger and resentment toward affluence would disappear if people appreciated just how hard the rich worked. “In the same way that a legend like Michael Jordan spent an insane amount of thought, practice, and discipline in becoming the heart and soul of a winning NBA dynasty, an entrepreneur who desires to create wealth for himself or the community must dedicate wild amounts of time and focus on his pursuit,” Bullen writes. “Unlike the mob gathered at the castle gates, I believe they have earned their wealth.”

What that mob fails to understand, according to Bullen, is that the economy is not a pie to be carved up and distributed. Rather, it’s a pie that can feed all of us, but only if entrepreneurs and innovators are allowed to keep growing it, hopefully forever. As an example of a company sharing the wealth, Bullen cites Amazon—an organization notorious for its anti-union tactics, for fighting worker benefits at every turn, for hiring a detective agency to spy on employees, and for warehouse conditions that have driven those employees to urinate in bottles. Yes, founder and former CEO Jeff Bezos has a current fortune of $164.9 billion. But, “contrary to the media-spun myth that these jobs exploit workers with low pay,” argues Bullen, “Amazon creates meaningful jobs across the spectrum.” Keep taxes low and leave rich people alone, Bullen advises, and we will all get richer. “Wealth creation is not about profits that seem to constellate at the very top only for the benefits of the very few,” he claims, but is a prosperity “spread across the landscape and shared by many.” Yet Amazon isn’t “spreading” Bezos’s wealth; it’s a business model expressly designed to accrue more wealth at the top by relying on a large, precarious workforce.

Bullen’s belief that the rich don’t hoard wealth to the detriment of everyone else has been convincingly defeated by the work of French economist Thomas Piketty. A core argument of Piketty’s Capital in the Twenty-First Century is that even the most well-deserved fortunes “can grow and perpetuate themselves beyond any possible rational justification in terms of social utility.” One of the ways Piketty illustrates the extreme concentration of capital is by analyzing publicly available data on university endowments, which reveal that the return on investment increases rapidly with the size of the endowment: universities with less than $100 million saw an average return of 5.1 percent between 1990 and 2010 while universities with the largest endowments (Harvard, Yale, and Princeton) saw returns of 10 percent over the same period. Universities with the greatest endowments can afford to spend more on portfolio management, which allows for more sophisticated investment strategies in unlisted foreign stocks, hedge funds, and derivatives.

What is true of university endowments is also true of individual wealth: the greater the fortune, the greater the potential for growth and the greater the gap between rich and poor. Bullen notes Piketty’s existence but dismisses his ideas as part of “a war on the rich.”

One thing the very rich fret over is how to keep their wealth in the family. What they face is often called the three-generation rule: the first generation makes the fortune, the second spends it, and the third is back to square one—“shirtsleeves to shirtsleeves,” as the saying goes. Speaking on behalf of rich families, Bullen worries that “the grandkids may inherit some cash, but they don’t have a guaranteed job as vice-president, president, or even chair of the family firm.” Without such guarantees, great fortunes can dwindle to nothing. For Bullen, this is yet more evidence that concerns about inequality are misguided, because social mobility remains fluid over time.

Yet, as Josh Baron and Rob Lachenauer argued recently in the Harvard Business Review, the three-generation rule, despite often being cited in family business, “could not be further from the truth.” The rule derives from a single, methodologically flawed study conducted in the 1980s, in which manufacturing companies in Illinois are taken as representative of all types of family businesses everywhere. While it is not impossible for rich families to return to penury, Baron and Lachenauer cite research on social mobility over generations that predicts a vastly longer regression to the mean—over “10 to 15 generations (300 to 450 years),” according one economist they cite. Indeed, a 2016 study of Italian tax records between 1427 and 2011 found that “the top earners among the current taxpayers were found to have already been at the top of the socioeconomic ladder six centuries ago.” Family businesses, in other words, last far longer than most companies.

Bullen believes that “business is a great equalizer” and that rich families enjoy no decisive benefits over the poor. It may be hard to make money, he says, but “keeping it is even harder. That is the sobering reality that presses on every rich person, 24/7, every day of the year.” This self-pitying claim has no basis in reality. Indeed, recent research reveals that Canada has steadily been going up the “Great Gatsby Curve,” which represents the relationship between wealth inequality and social mobility. A 2021 study of administrative tax data by Statistics Canada found that, as parental income grew more unequal, social mobility of children steadily declined. In practical terms, this means that, as income inequality gets worse, children born in the bottom 20 percent of income distribution are increasingly unlikely to ascend to the middle class.

As it becomes harder for poor children to escape the circumstances into which they were born, the very wealthy are working tirelessly to ensure that their money stays in the family. Wealth-X, an organization that, according to LinkedIn, “boasts the world’s most extensive collection of records on wealthy individuals,” predicts a staggering $18 trillion (US) in generational wealth transfer over the next decade. This is the result of almost one-quarter of high-net-worth individuals—people with $5 million (US) or more—handing off their wealth to the next generation. It comes as no surprise that the very wealthy are attempting to secure dynastic wealth via every possible means—including by attempting to eliminate the rule against perpetuities (RAP), a long-standing legal principle in Anglo-American common law preventing the rich from using deeds or wills to continue owning property long after they have died. In the past few decades, three Canadian provinces and more than half of US states have abolished the RAP: in the words of legal scholar Eric Kades, these jurisdictions “now permit decedents to create so-called ‘dynastic trusts’ that control the disposition of their wealth not just for one or two generations, but rather for hundreds or thousands of years—or forever.”

Texts like In Defence of Wealth are nothing new and were especially popular during the Gilded Age, when Orison Swett Marden’s Pushing to the Front (1894) and Andrew Carnegie’s The Gospel of Wealth (1889) were widely read. When Bullen claims that the average Canadian now enjoys luxuries that were unavailable to billionaires of the past, he echoes, intentionally or not, Carnegie’s proclamation that “the laborer has now more comforts than the landlord had a few generations ago.” But, where Carnegie preached the moral value of giving away wealth during one’s lifetime—“The man who dies thus rich dies disgraced”—Bullen is expressly concerned with defending his wealth by keeping it in the family and repeatedly warns that increased income taxes will cause the wealthy to pick up and leave for more attractive jurisdictions.

Bullen’s belief that we should be grateful for whatever the super-rich do—for jobs in the gig economy or on the warehouse floor—reveals that his work is the spiritual descendent not of Carnegie’s Gospel of Wealth but of Rudyard Kipling’s poem “White Man’s Burden,” which attempts to justify imperialism as a noble duty. Where the rapacious nineteenth-century empires cloaked their pillage and exploitation of colonies in a rhetorical skein of generosity, offering progress and salvation to locals, the contemporary identity politics of the super-rich present them as existing primarily for the benefit of those they exploit for profit. We shouldn’t criticize the 1 percent, Bullen repeatedly insists—we should thank them. We should want more of them. Indeed, he says, by griping about inequality and wealth, left-wing media and politicians are playing a dangerous game, duping people into thinking that democracy is rigged against the poor, which drives them into the arms of authoritarian strongmen. The real culprits behind right-wing populism in countries from Brazil to Turkey, Bullen asserts, are the left-wing ingrates whinging about the gap between rich and poor.

While the rich once found it propitious to inspire their lay readership by spreading a “gospel of wealth,” In Defence of Wealth assumes a defensive posture from the title onward. The reader is never allowed to forget that this is a manifesto of the 1 percent pushing policies for the benefit of that 1 percent. Yet, despite the glaring advantages enjoyed by the rich, for as long as Canada remains a democracy, the 99 percent have strength in numbers. We should start with a 77 percent estate tax (the rate that presided over an unprecedented era of economic growth in the US, from 1941 to 1976), a global asset registry to make it harder for the very wealthy to hide their money in off-shore tax havens, and efforts to lobby other countries to impose wealth taxes, making it more difficult for the rich to flee to low-tax environments.

We should not for a second believe that the unlimited accumulation of wealth by the rich “benefits us all.” To the contrary, as we return to a level of inequality some argue has not been not seen since the end of the feudal order, most of us are already the figurative boars on the floor, oinking for our masters, fighting for whatever scraps they see fit to bestow.