In 1992, the worst drought in 100 years struck southern Africa, devastating farms throughout the region. The Limpopo River, which winds its way through Botswana, South Africa, Zimbabwe, and Mozambique, drained down from its usual torrent into a ribbon of cracked mud flats, and the Food and Agriculture Organization of the United Nations declared that the area’s harvests would plummet by half. The already meagre regional food stockpiles disappeared fast. African officials faced the prospect of having to import almost seven million metric tons of grain, about six times more than the year before, when the weather had been dry but not catastrophic. Experts calculated that 17 to 20 million people were at risk of starvation. Development workers on the ground in Africa described the disaster as “the apocalypse drought.” Yet few famine-related deaths occurred. Not only did people survive; they remained on their land and in their villages, and managed to maintain local production systems, the foundations of communities. This meant that when the rains returned the following year, everything recovered quickly. In some development circles, the apocalypse drought of 1992 is now referred to as “the famine that wasn’t.”

In their 1998 book, Who’s Hungry? And How Do We Know?, American social scientists Laurie DeRose, Ellen Messer, and Sara Millman tell the story of a coordinated response to the crisis. It remains a lesson in effective planning. Long before the spectre of the drought ever reared up in meteorological models, development assistance had funded plant breeding programs to create drought-resistant varieties of sorghum and millet, two grains traditionally used by small-scale farmers to weather tough times. So when the rains dried up, they had already planted varieties that could withstand thirst. Months in advance, “famine early warning systems” employed the latest forecasting technologies and economic data to alert international donors and local governments that crops were failing and prices were rising. This allowed the nations of the Southern African Development Community to release regional stockpiles into markets early, keeping prices, and consumer panic, tamped down.

Governments also exploited cash for work and food for work programs and loaned money to farmers, opening the spigots for aid. Even international donors stepped up. The United States, which happened to have large reserves of yellow corn when southern Africa was most in need, donated heavily. Existing transportation and communications systems proved responsive enough to deliver food from distribution centres to vulnerable communities. And the South African government made a very public commitment to import grain, which convinced merchants not to hoard stockpiles in hope of higher prices.

The lessons of the famine that wasn’t are especially useful today. Over the past five years, a combination of awful weather in key grain-producing regions and bad economic and agricultural policies, as well as rising energy prices, have plunged the world into a protracted food crisis. The problems began in 2007 when the drought in Australia coincided with soaring demand for food (meat in particular) in Asia, and the American government’s decision to plow 40 percent of the American corn harvest into ethanol. As demand outstripped supply, a storm of commodity speculation drove up cereal prices by 75 percent in one year.

Related Link

Video: Feeding Nine Billion

Evan Fraser’s four-part plan to solve the Global Food Crisis

Food prices followed, rising by about 50 percent. As commodity prices climbed in early 2008, food riots broke out in dozens of countries, and the number of hungry people worldwide swelled to one billion—about one in seven. Along with hurting consumers, rising prices increased the cost of food aid, just when it was needed most. The UN’s World Food Programme estimated that for every 10 percent jump in the price of food, its aid costs rose by $200 million (US).

Then Mother Nature showed some mercy. The 2008 crop broke world records, and the world’s grain silos filled. Prices eased, and global food security slipped out of the headlines. Or it did until 2010, when summer droughts and wildfires destroyed about 25 percent of Russia’s wheat crop, spurring the Kremlin to ban exports. This assuaged panic among Russian shoppers, but sent shock waves through the global markets. By early 2011, commodity prices had ballooned again to record levels, and the cost of food soared in places that depended on Russian wheat, such as the Middle East and North Africa, where food riots in Tunisia and Egypt escalated into the Arab Spring.

This pattern repeated in early 2012, when the US Department of Agriculture announced its forecast that American farmers would reap an unprecedented harvest of 14.8 billion bushels of corn. Reacting to this news, commodity prices drifted downward as grain merchants unloaded their inventories, selling out on the expectation that prices were about to drop. But in late June and early July of this year, just as North America’s corn crop began to pollinate (when the plants are most susceptible to water and heat stress), the rains stopped and the mercury soared. The continent entered one of the hottest, driest summers on record.

In response, the USDA re-evaluated its harvest estimates, and commodity markets started acting jittery. As the summer broiled on and the drought’s magnitude became apparent, optimism shrivelled. At the time of this writing, the US government’s best estimate is that the corn harvest will be less than 11 billion bushels, putting 2012 among the four worst harvests in a decade.

By the end of summer, corn prices had never been higher, and in the corridors of agriculture departments and ministries there was once again talk of food security and unrest. In September, analysts at Rabobank, a Dutch bank specializing in international food and agribusiness, released a report predicting that rising grain prices would lead farmers around the world to cull cattle and pigs they could not afford to feed. This may cause an initial glut of meat on the market, but it will mean fewer steaks and fewer breeding animals in the near future. Next year’s food prices are expected to set record highs. Whether they provoke another major crisis, with rioters throwing Molotov cocktails and overthrowing their dictators, remains to be seen, but the world is still in the midst of a long-term, systemic food crisis.

In the latter half of the twentieth century, the great societal challenges were civil rights and nuclear brinkmanship. The late twenty-first century will face another: how to safely, sustainably, and adequately feed the growing population. By 2050, demographers predict the world will have two billion more bellies to fill. Population pressure, coupled with climate change, means that unless we find a way to produce about 50 to 100 percent more food, and unless we figure out ways to distribute the calories we have much more efficiently, the next phase of human history will be marked by daily bread so expensive that it could provoke new wars and mass migration. Most politicians and agriculture experts understand this. Where they differ, though, is on how best to address the crisis.

Grain, like oil, is a strategic asset. Without it, people suffer and governments fall. The world’s demand for it is constant and growing. But unlike oil, grain is not treated with the importance it deserves. Over the past two decades, the global community has adopted a “just enough/just in time” approach to food, wherein we produce only enough to cover our needs in most years. In six of the past eleven years, we consumed slightly more food than we produced, and the buffer we carry from one year to the next has shrunk steadily. This raises an interesting parallel between food and the financial world. Throughout the 1990s and the early 2000s, while our stock and housing markets yielded unprecedented returns, we also reaped a series of world record harvests. Yet our food consumption, just like our spending, regularly exceeded our production.

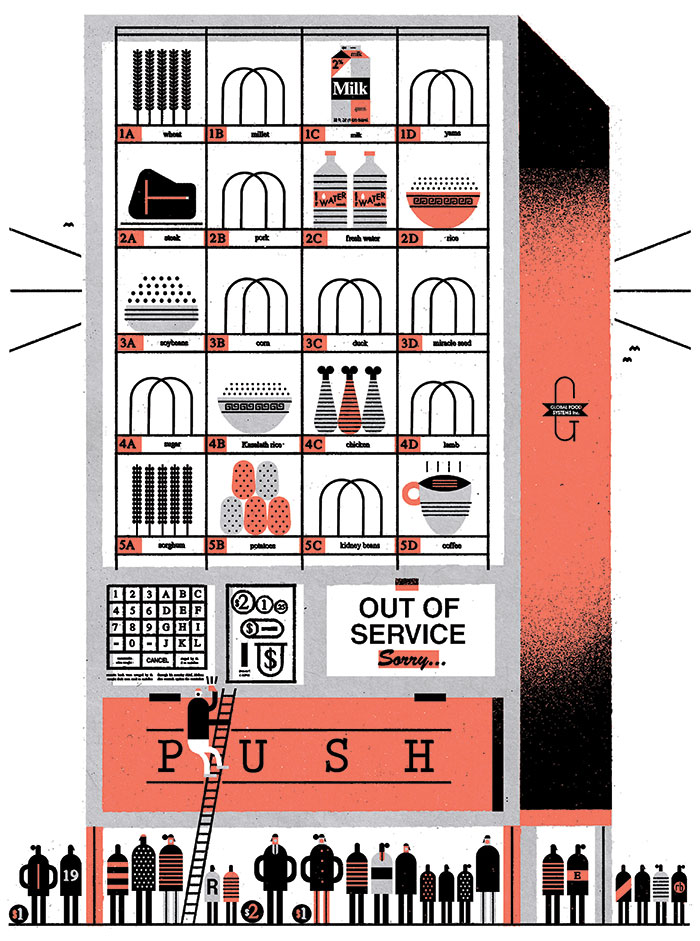

If the problems that plague our food system are similar to the ones plaguing our financial system, the opposite may also be true: sound financial practices may offer strategies to help us stem the food crisis. The components needed to feed the planet can be compared to those of a balanced investment portfolio, with high-risk stocks that hold the promise of fast growth, bonds and blue-chip stocks that offer long-term stability, and a healthy cash reserve to weather a serious economic downturn.

High-tech agriculture methods—new breeds of seeds, tractors linked with satellite navigation systems—are similar to high-risk, high-octane IT stocks, and an important part of a profitable investment plan. Just as an investor would be foolish to forgo the promise of high returns, we will need ambitious science to develop the agricultural tools that will keep our fields productive as nutrients, energy, water, and land all become more scarce. In particular, science can help farmers close the “yield gap,” or the difference between how much food a region can theoretically produce and how much it actually does. In the American corn belt, most farmers never reap more than 250 bushels of corn per acre in a good year (between 150 and 200 would be more typical for many parts of the US), but scientists working on test plots can obtain more than 300 bushels of corn per acre. In the southern hemisphere, yield gaps can be enormous; parts of Africa produce a mere 20 percent of what they potentially could. Closing such gaps is not necessarily difficult, but it requires working on the ground to ensure that farmers can access high-quality seeds, soil nutrients, and other resources.

For instance, rice farmers around the world know their crops are often limited by the level of phosphorus in the soil. This is a serious bottleneck, as the element is found in just a handful of mines around the world and supplies are running out. The shortage is predicted to become so acute that it will severely limit worldwide agricultural production. Experts have long known that a traditional variety of Indian rice, Kasalath, can grow in phosphorous-deficient soils. In 2012, researchers demonstrated that they could isolate the gene responsible for its hardiness and breed it into other types of rice.

It would be naive, however, to assume that science and technology alone will save us. In many cases, developing new seeds and their associated fertilizers and herbicides has profited private corporations more than these technologies have benefited humanity or the environment. And critics worry that promoting a science-based approach to agriculture will only result in more food being produced in the developed world, since this is where farmers and consumers have deep enough pockets to afford the new, often capital-intensive technologies. Farmers in Africa, Latin America, and Asia have less access to miracle seeds, even though they need them most.

So, just as a good financial adviser would never counsel a client to only invest in one type of high-yield stock, we need diversity in our food security strategy. Even if local food systems never feed all of us all of the time, they offer vital protection from swings in the international market. They are the bonds and GICs of the food world. They also provide communities with jobs, services, infrastructure, and meaningful relationships between urban and rural residents. They give consumers the power to directly influence the food they eat. One of the biggest problems with the global food system is that individual consumers have little control over it. As Raj Patel, author of Stuffed and Starved, writes, you cannot have food security unless you have food sovereignty.

We also need to store more food. Just as every sound investment portfolio builds in a cash reserve for emergencies, we ought to store food on a large scale, analogous to having a bag of bullion hidden away under a floorboard. Our governments should set aside a portion of any surplus to stock the global larder for lean times. But in this regard, the trends are worrying. The Food and Agriculture Organization of the United Nations measures the stock-to-use ratio, or the amount of food we carry over from one year to the next, expressed as a percentage of our total use, to calculate how much food we have in reserve. A decade ago, the world maintained a 25 percent stock-to-use ratio for all of our major grain crops, a reasonable cushion. As of this writing, the UN estimates that the ratio next year will likely be about 20 percent. Because of the terrible weather in North America this year, corn supplies are way down and our stock-to-use ratio for corn and other coarse grains is a mere 13.3 percent. These numbers are especially worrying for the developing world, since people there spend a large portion of their income on food. Fewer reserves ultimately mean higher prices, and there is no longer any real protection between a jolt of bad weather and tens of millions of households falling into poverty.

As we know all too well, banks behaved badly when regulators relaxed the laws on mortgage lending. Big Food is no different, and the last piece of our sustainable food portfolio is regulation, a legal framework of incentives to conserve more food, fund better technologies, and promote local systems. For one of the authors of this article, the need for government intervention took a palpable form when he visited a Colorado feedlot last year. The facility was licensed to hold 100,000 head of cattle, but in addition to its bovine residents it harboured a 370,000–metric ton pile of manure plopped alongside a waterway—a pungent symbol of regulators’ failure to keep industrial agriculture from literally soiling the environment.

No solution is perfect. New technologies (phosphorus-independent wonder rice, for instance) may give more power to the Big Food corporations that hold the gene patents, at the expense of small-scale growers who are forced to buy the super-seeds. In certain parts of the world, notably India, this sort of dynamic has already impoverished many farmers. And government regulation can tie up smaller farmers in red tape and prevent them from efficiently earning a living. Storing food can be expensive and defers profits. But we cannot use such criticisms to paralyze us. It is only by developing a balanced portfolio of approaches that we will muddle through the dark times ahead.

The 1992 African drought passed with remarkably little hardship, and the agricultural system recovered, as it always has. One of the few Old Testament stories to end on a happy note is the tale of Joseph and the Pharaoh’s dreams. In it, the Pharaoh dreamt that seven fat cows emerged from the Nile River, followed by seven thin cows that devoured the fat ones. Then he dreamt that seven thick heads of grain emerged on a stalk, followed by seven thin heads that ate their fatter siblings. Joseph interpreted the seven fat cows and seven thick heads as a good weather report, signifying seven rich years, which would be followed by seven lean years. To save Egypt from a future famine, he advised the Pharaoh to set aside the surplus in the good years, and store grain in silos to prepare for the rough times ahead. Pharaoh took his advice, and hunger never struck.

Today we have climate modelling software rather than flashes of mystic prescience. We are certain that the years 2050 through 2080 will not see the same growth as those between 1950 and 1980, but this does not have to spell disaster. By acting in advance and enacting strategies to solve tomorrow’s problems, the story of the twenty-first century can end like Joseph’s. Disaster or survival, then as now, is simply a matter of reading the signs and taking action.

This appeared in the December 2012 issue.