Listen to an audio version of this story

When OnlyFans declared on August 19, 2021, that it would soon ban porn from its platform, it seemed an unusual, even baffling, move. The subscription and pay-per-view service is home to a range of content creators, including fitness experts, chefs, celebrities, and musicians. But it ultimately became a household phenomenon by connecting audiences directly to porn creators for everything from lingerie shoots to hard-core fetish clips. Following the ban announcement, creators flocked to social media in confusion and concern. Memes predicted a swift demise for the company betraying the very user base that had made it famous. Less than a week later, OnlyFans rolled back its decision. As one Twitter user put it: “banning porn? psh, those were OnlyPlans.” It seemed a win for sex workers, but the dust-up hints at a more troubling story: the routine financial discrimination against millions of precarious workers.

In an interview with the Financial Times, OnlyFans founder and CEO Tim Stokely blamed the chaos on corporate struggles, including the frequent refusal by major banks to process its transactions or host associated accounts. Such obstacles have fed the platform’s anxieties about its long-term profitability. Despite a user base of over 130 million, OnlyFans has failed to attract venture capital. Its association with adult content would appear to be scaring off investors and financial institutions, likely thanks to American evangelical lobby groups that have succeeded in conflating legal pornography with sex trafficking and child abuse through a number of baseless claims. These religious crusaders generate op-eds, organize social media campaigns, fund antiporn documentaries, and, most recently, have put intense pressure on payment processors to financially discriminate against porn performers.

For Rebecca Sullivan, a pornography studies scholar at the University of Calgary, the relentless moralizing is a smokescreen for regressive politics. “Sex work is not uniquely degrading,” she says. “It is simply a job.”

Sullivan is especially frustrated by the ways sex workers are forced to wear a financial scarlet letter under the guise of risk mitigation. Credit card companies complain that adult content generates high rates of chargebacks—the term for when a customer contests a transaction and asks for the charge to be reversed. When it comes to porn, embarrassed clients will report the transaction as fraud rather than admit to the purchase. Credit card companies hate chargebacks. They not only impose high fees on merchants for them but will terminate their accounts if chargeback frequency exceeds certain limits. Excessive chargebacks plague many industries: auctions, online gaming, event ticket sales, multilevel marketing, and more. But when your business is regarded as a reputational liability—as porn is—payment processors are quick to blacklist.

They are also loath to get on board. Kate Sinclaire, porn producer and founder of Ciné Sinclaire, recalls the early days of her thriving production company in Winnipeg and how she was denied loans by all five major Canadian banks. The reason cited was the risky nature of her work, which Sinclaire knew was code for chargeback concerns.

Exasperation with these challenges is what appears to have pushed OnlyFans to propose the porn ban. When it reversed its decision, the company claimed it had “secured assurances necessary to support our diverse creator community.” But, as the New York Times reported, OnlyFans was really responding to bad PR and “the backlash of creators” against the platform’s betrayal. Fighting financial bias is now a full-time job for those involved in porn, and chargebacks are one of the many ways they are discriminated against. Merely existing as a sex worker can impact any and all personal transactions. Indeed, if you’ve been flagged on suspicion of sex work, even something as innocuous as renting a holiday Airbnb can lead the home-sharing site to cancel your bookings or account.

“You can never not be a sex worker once you’ve been identified as one,” agrees Katy Churchill, a webcam model and fetish-clip producer based in Vancouver. “They can functionally make it harder for me to get by,” she says, referring to the financial community. Platforms like PayPal and Venmo have also come under fire for freezing the assets of sex workers without warning or due process.

Valerie Webber, a porn performer and researcher who specializes in occupational health in the sex industry, blames banks for generating “perpetual shame narratives” about adult work. “Performers and producers are denied personal credit cards, have accounts suspended, incur bloated transaction costs, and even face outright exclusion from essential financial services.” Worse, Webber continues, these policies pointedly target a workforce composed largely of women and trans and queer folks.

The concept of risk management also grants payment processors authority to determine for the rest of us what kinds of acts are “objectionable.” Acceptable-use policies frequently privilege white and heterosexual content over queer, POC, or marginalized depictions of sexual activity. Simply put, the targeting of legal pornography has gone beyond the scope of mere PR management. Instead, it highlights the immense influence platforms and banks have over the fantasies people are permitted to safely explore through media.

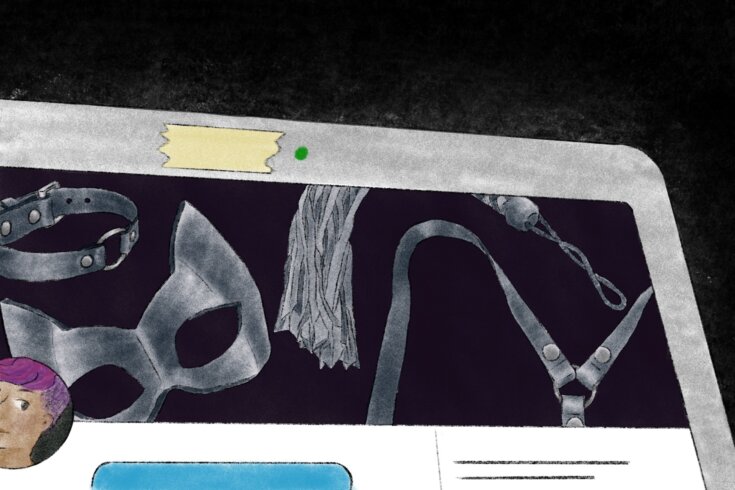

By the time Tumblr booted pornography from its site, in 2018, in order to fully comply with the Apple App Store’s antiadult clauses, the microblogging tool had become a haven for LGBTQ2S+ users, sex workers, erotica writers, and artists searching for solidarity. That safe space disappeared for good. Platforms and banks don’t simply determine what kind of porn you can watch but also what kind of sex toys you can buy—if they allow you to buy them at all. It’s no surprise, then, that financial discrimination against sex work has become a flashpoint for advocates of freedom of expression and economic rights, such as the Electronic Frontier Foundation, the Free Speech Coalition, and the American Civil Liberties Union.

In other words, a world in which payment processors and content platforms rule unchallenged is a problem not just for porn creators and consumers. It also establishes a precedent, allowing private companies to set opaque, moralizing, and arbitrary censorship terms without oversight. In an article for the cryptocurrency-focused news site CoinDesk, columnist David Z. Morris saw OnlyFans’ attempt to appease payment providers as a warning for anyone “concerned about the power of banks to effectively shut down businesses they don’t like by cutting off payments services.” Morris called the OnlyFans incident “a watershed moment”—a rare instance where a free-speech clash with financial institutions ended in a win for users and workers.

As traditional employment crumbles under the influence of technology, once-stable careers are segmented into gig work and low-paid contract tasks. It’s easier than ever to see ourselves drawn near to the financial straits faced by porn performers. Sex work—an industry forced to the margins under an exhausting cycle of economic uncertainty—is a case study on the future of work itself: precarious, heavily surveilled, and at the mercy of bigger players and their fickle business strategies. While the OnlyFans episode may herald a sea change for workers challenging corporate censorship, it remains a cautionary tale. That banks and payment processors can deny services to an entire class of workers is a form of labour discrimination that should alarm us all.