Early in the pandemic, “dirty money” started to take on a new, rather literal, meaning as businesses across Canada—from local stores to large retailers like Second Cup—banned the use of cash. Before we understood the coronavirus’s aerosol-based transmission, every surface seemed a threat: doorknobs, groceries, and, of course, money. By May 2020, the number of “tap and go” transactions escalated so dramatically the Bank of Canada issued a plea for retailers to continue accepting notes and coins “to ensure Canadians have access to the goods and services they need.”

There’s no question printed or minted currency is grubby and kind of gross (paper banknotes, studies demonstrate, can be covered in everything from E. coli to fecal matter). But we now know its likelihood of spreading the coronavirus is as low as any other high-traffic surface. Still, the reluctance among businesses and consumers to handle money might prove hard to shake. E-commerce has been systematically dethroning cash in Canada throughout the past decade, and experts believe the pandemic has accelerated the trend. Indeed, according to a 2021 report from Payments Canada, around 40 percent of Canadians say the pandemic has turned them off cash for the foreseeable future. As Canada becomes one of the most cashless countries in the world, with a projected 70 percent drop in usage by 2030, we have to reckon with the consequences of a mass switch to digital payment.

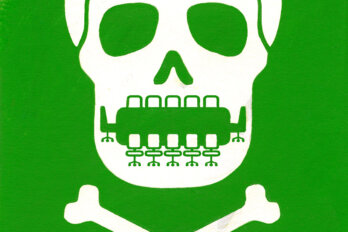

Those consequences will likely be invisible to those of us who don’t have to worry about accessing bank accounts and credit cards. But, if you’re someone who does have to worry, the digitization of the economy could likely make it difficult to pay for food, basic goods, and transit. In our rush to abandon cash under the guise of technological progress, are we leaving behind the people who rely on it most?

It’s easy to assume everybody has a bank card or a line of credit, but according to the social justice group ACORN Canada, 15 percent of Canadians are “underbanked,” meaning they have limited interaction with traditional banks, and a further million are estimated to have no bank accounts at all (this may be a conservative figure due to spotty data collection).

Some of these people may simply prefer to use cash or cheques for personal or privacy reasons, but many are excluded for reasons beyond their control: prohibitive banking or ATM fees or no reliable access to bank branches, an inability to qualify for credit, or a lack of knowledge or resources to access digital banking services. Without bank accounts, people tend to rely on cash, meaning that the popularity of cash-free policies could quickly box them out of society.

In areas with few retail options, for example, the trend could seriously jeopardize access to essentials. Back in June 2020, then executive director of the Canadian Civil Liberties Association Michael Bryant told the CBC that pushing people to use electronic payment can actively “[threaten] food security” by making it difficult for people to reliably purchase their groceries, adding “another layer of anxiety” to daily life. Most of these people, according to research, are already low income and marginalized, with Indigenous, disabled, homeless, and remote communities hardest hit. Unlike in certain jurisdictions in the United States, such as Massachusetts, DC, and New York City, there is no law at any level in Canada that requires retailers to accept cash, a Bank of Canada spokesperson told Global in 2020—only that they must accept some kind of valid payment. This means that there is no guardrail for those locked out of credit or debit.

It’s not just making purchases that is difficult for the un- and underbanked—receiving payments, including government cheques, can become awfully expensive as well. The majority of communities in Nunavut, for example, have no bank branches at all. Similar situations exist across parts of Yukon, which can leave some with little choice but to rely on exploitatively priced cheque-cashing stores. Bonnie Morton, a Saskatchewan antipoverty advocate, told CTV in 2020 that people without bank accounts often face “huge fees” when cashing cheques at places like money marts, which usually charge both a base rate and a percentage of the cheque’s total value. If, for example, you needed to cash a $1,000 wage cheque twice a month, a fairly standard fee of $2.99 per cheque plus 3 percent of the value would see you losing $32.99 each time, or almost $800 over the entire year. As Morton put it, “A cashless society only works for those with enough money.”

Many of Canada’s rural and remote communities are also notoriously poorly served by internet services, making it difficult to rely on internet banking alone. And, since banks have been shuttering branches at rapid rates for years, with over 2,000 closing their doors between 1990 and 2017, the situation doesn’t look set to improve any time soon.

There are options for solving the cashlessness quandary without shortchanging the country’s most vulnerable—if Canadian officials are willing to put in the effort to make them happen.

One idea that has become popular is the use of prepaid cards: reloadable payment cards that resemble credit or debit cards. Historically, they have been an efficient way for governments to quickly send money to people without access to banking services, since they are easily distributed by mail and give recipients immediate access to funds. Governments have used them to provide help in a pinch in the past, such as to aid wildfire victims in Alberta, and advocates say prepaid cards could have proved helpful if they had been deployed during the pandemic to distribute the much-needed Canada Emergency Response Benefit (CERB), which they were not.

To the degree that they have been deployed in Canada, prepaid cards have proved to be fairly successful in distributing benefits; in Ontario, their use for unemployment and disability programs likely helped recipients avoid cheque-cashing fees and reduced costs for the government to the tune of about $1.7 million per year. If adopted more widely, and used for things like federal tax returns and other kinds of government aid, prepaid cards could prove extremely useful for transitioning unbanked and underbanked people into an increasingly cashless society.

Another answer might lie in the busy hands of Canada Post. Many countries, including the UK, France, Italy, and China, use their post offices to offer banking services, both in person and online, at low cost. In rural communities that aren’t well served by banks, the initiative has become vital. Setting up such a service here is not unimaginable: postal banking was a part of Canadian culture for over a century, up until corporate lobbying from the banking industry put an end to it in 1968. Despite continued resistance from mainstream banks, the concept has widespread support; over 600 municipalities, across almost every corner of the country, have passed resolutions supporting postal banking. The Canadian Union of Postal Workers supports it too. John Anderson, a researcher and consultant, argued in a 2013 paper that traditional banks, with their sparse branch distribution and high fees, have long been failing Canadians. With post offices in over 1,200 communities underserved by banks, Canada Post’s infrastructure—comprising well-established networks integrated into local communities—could be key in expanding financial inclusion to the country’s most rural and remote populations.

Widening financial inclusion also means distributing the resources required to engage in digital banking, such as providing low-cost laptops and phones to people who can’t afford them. We had a preview of what this could look like during the pandemic, when community initiatives supplied electronics to people in order to attend virtual health appointments and ease isolation. But small-scale, charity-driven outreach can only go so far, especially when such outreach is often limited to large urban centres with decent internet. If Canada is serious about making sure people can participate in the digital economy, communications devices and internet access might need to be seen more as a right than a personal luxury.

The cashless trend might be inevitable. But there are ways to prevent the unbanked from becoming collateral damage. Canada could provide better access to laptops and phones for those who want them and explore imaginative solutions for those that don’t, all while relying on structures and methods that already exist. Financial-inclusion advocates are more than ready to make the change, but the penny has yet to drop for our political representatives.